The retail regulatory framework: Still fit for purpose?

During the height of the COVID-19 pandemic, retailers in Australia were increasingly concerned that the impacts of government interventions intended to protect consumers during a significant economic downturn might unintentionally impact the ability of retailers to meet their upstream obligations.

The Australian Energy Council (AEC) undertook several steps to ensure the balance between protections and viability remained stable. Initially, the AEC obtained an authorisation from the Australian Competition and Consumer Commission (ACCC) to ascertain whether the regulatory frameworks, additional COVID specific protections, and retailer processes were adequately protecting the needs of consumers. This authorisation enabled retailers to discuss these supports, and illustrated that the presence of JobKeeper, the increased JobSeeker payment, and the prohibition on disconnections was ensuring immediate detrimental outcomes for consumers could be avoided.

Yet the impacts on retailers of providing these additional protections remained a concern – on top of the already notable consumer protections regime in place across the National Electricity Market (NEM) - and the longer-term debt implications for customers.

To look deeper into this issue, the AEC commissioned Synergies Economic Consulting and today has released the resulting comprehensive report.

The work considers whether the original market design remains fit for purpose in 2021. It also ascertains whether any amendments to either the risk allocation or regulatory structure of the market is necessary to ensure the retail market remains viable into the future.

Report scope

Synergies conducted a first principles assessment of the allocation for non-payment risk on the retail market as it was designed in the early 2000s and compared this with the practical challenges facing retailers today. With this understanding, and consideration of the experiences in similar overseas jurisdictions and essential services, potential regulatory or structural reforms that might enable the retail sector to remain viable were also identified.

Additionally, Synergies was tasked with considering how these risks, as well as the costs of implementing regulatory interventions, might be recovered in a price regulated retail market.

Findings: How we got here

The large number of reforms imposed into the retail regulatory framework is well documented. However, it should be noted that during the first 6 years of the National Energy Customer Framework (NECF), the regulatory frameworks remained fairly stable. Most reforms were implemented between 2018 and 2020, seeking to resolve perceived market failures.

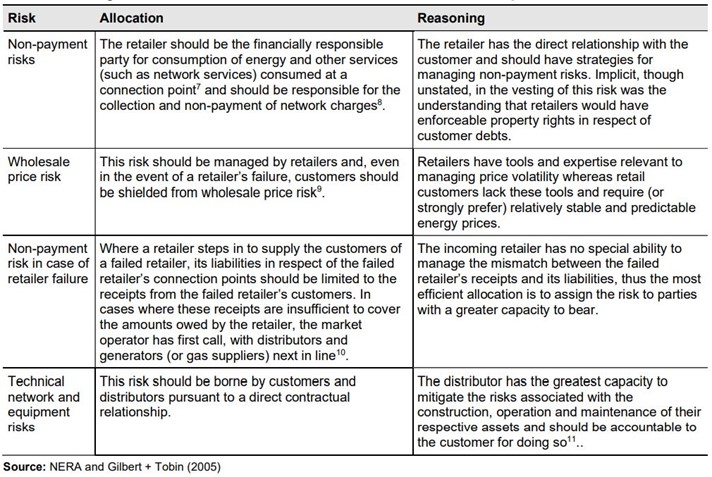

When the NEM was designed, the retailer was envisaged as being in control of the customer relationship, empowered to manage the risk of non-payment, while protecting other parties which did not have that direct customer relationship.

Figure 1: Design recommendations of the NERA and Gilbert + Tobin Report

The designers anticipated that customers, in particular small customers, should have the benefit of various restrictions on energy suppliers to make transacting easier and fairer, such as having standard terms and conditions approved by a regulator, but emphasised: “The scope of regulation should be sufficient to ensure small end-customers are treated “fairly” but should not be so wide or prescriptive as to impose regulatory costs which exceed the benefits.”

In 2016, policy makers became increasingly concerned that this light touch framework was not delivering for all consumers. Politicised largely by rising energy prices, the retail market was put under the spotlight by the ACCC and the Victorian Government’s Thwaites review, which raised a number of concerns about the manner in which retailers were delivering for consumers. Of greatest concern was the perceived ‘unfair’ outcomes facing customers who failed to engage in the market, and the ability of retailers to support customers unable to pay their energy bills.

What followed was an intense period of interventions, in both Victoria and the NECF states.

Re-evaluating the allocation of economic risks in 2021

The Synergies report considers how economic risks should be allocated based on the original market design and compares this with the outcomes we are seeing today.

First, risks should be assigned to the party best able to manage the risk having regard to:

- business systems; and,

- product/service designs, customer relationships and engagement.

Secondly, risks should be assigned to the party best able to bear the risk, including possessing the financial capacity of the entity to absorb and recover from uncertain future losses.

Capacity to manage non-payment risk

Regulatory and policy interventions have diminished electricity retailers’ capacity to manage non-payment risk (e.g. the Victorian Payment Difficulty Framework, Australian Energy Regulator’s Statement of Expectations of energy businesses) due to:

- disconnection and the threat to disconnect now having greatly diminished usefulness; and,

- engagement with customer in relation to their outstanding debt often being tokenistic and used to frustrate retailers’ non-payment risk management.

Capacity to bear non-payment risk

Regulatory and policy interventions have also diminished electricity retailers’ capacity to bear non-payment risk primarily due to the introduction of regulated retail price caps.

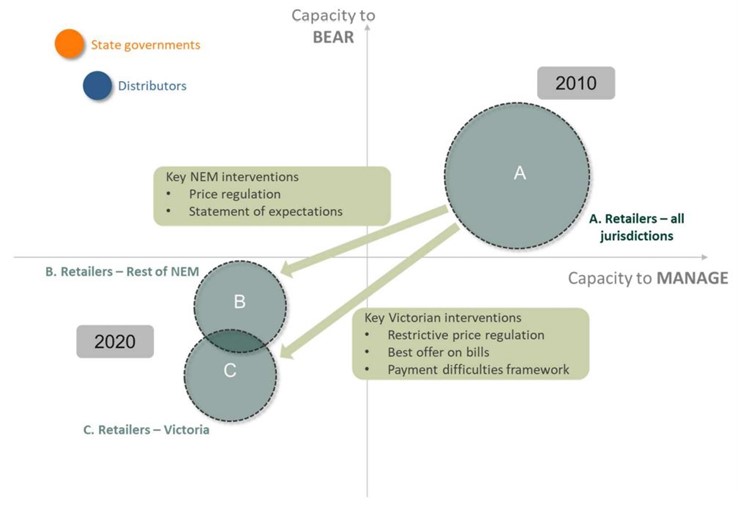

Synergies’ overall assessment shows that since 2010, in aggregate, the capacity of retailers to manage and bear risk in both the NEM and Victoria has been compromised relative to an optimal risk allocation and the one that was originally intended in the NEM.

Figure 2: Outcomes of interventions for efficiency of risk allocation

Source: Synergies analysis

In aggregate, they consider that the regulatory and policy interventions have negatively affected the ability of electricity retailers to both manage and bear non-payment risks. This adverse development has been exacerbated by the economic effect of the COVID-19 policy response.

Interventions in the NEM

Synergies analysed the impact of 34 interventions that have been imposed in recent years across the NEM. Largely these interventions focused on customer welfare, with half focusing solely on vulnerable customers.

These interventions have impacted the ability of retailers to manage and bear risk and have often come at a high cost.

With increased pressures on the ability of retailers to bear risk (predominantly due to price re-regulation) and limitations on the tools available to retailers to manage debts, retailer outcomes declined. Synergies considered that while retailing was not unviable, further interventions that did not consider the risks faced by retailers might place this balance at risk.

Figure 3: Implications of interventions for different customers and suggested focus areas

Source: Synergies analysis

International experience

Synergies looked closely at the UK retail market to compare the outcomes experienced by retailers and customers under a comparable framework. Interestingly, disconnection is much less of an issue in the UK, with most retailers voluntarily opting not to disconnect vulnerable customers. However, even without disconnection, debt is avoided through a strong prepayment meter regime. Retailers are able to impose prepayment meters onto customers who fall into debt and are even able to transfer debt to new providers. Both of these actions are expressly prohibited in all NEM jurisdictions.

In Australia, prepayment meters are allowed in South Australia and Tasmania, and in some remote areas in Queensland. Victoria expressly prohibits any prepayment meter contracts, while NSW has not opted into the NECF prepayment rules.

Other than low disconnections and a high use of prepayment meters, the Australian and UK markets are relatively closely aligned. However, UK suppliers appear to have been more proactive in developing industry standards around customer hardship than Australian retailers, resulting in less onerous government interventions.

Importantly, Synergies found UK suppliers were able to weather not disconnecting customers because they had at their disposal “debt management solutions that are appropriate for the customers’ circumstances, such as repayment schemes, PPMs, Fuel Direct, referral to debt advice agencies, and social services via dedicated support teams”.

Recommendations

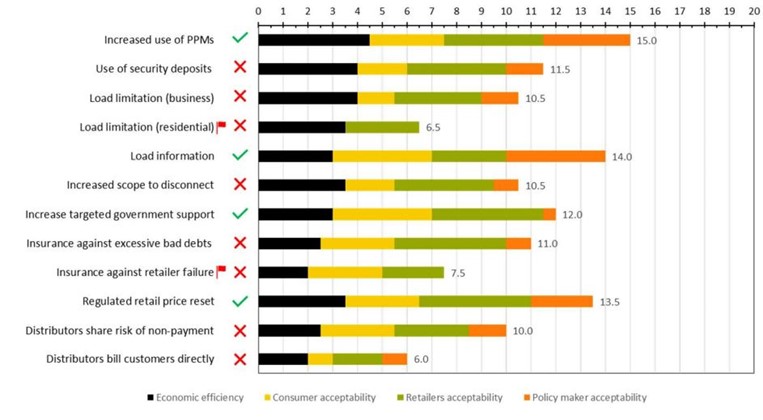

Synergies looked at alternative policy, technical, and regulatory responses that might better balance the risks faced by retailers in the market with the desired outcomes sought by governments and other stakeholders.

They assessed these options through a theoretical lens of economic efficiency, acceptability to consumers, acceptability to retailers, and acceptability to policy makers.

Of the options assessed, Synergies determined that an increased use of prepayment products, increased load information, and better reflecting risks in regulatory price reset processes would deliver the optimal benefits against these criteria.

Figure 4: Option scores – all criteria (equal weights)

Source: Synergies analysis

Importantly, these approaches are not unknown in Australia, however to date, have not been designed based on the environment today. For example, prepayment as described in the NECF, envisages a specialised prepayment meter being physically installed, and a customer needing to go to a local vendor to buy credit to manually enter into the meter. Today, smart meters would render this type of offering obsolete. Similarly, customer side information is only just starting to roll out effectively in the NEM, with retailer controlled smart metering infrastructure increasing innovation. These two recommendations provide significant upside should they be redesigned by the industry in conjunction with consumers.

The report also highlights that pricing risks into regulated price resets is an important discussion that needs to be had with regulators and governments. Current pricing methodologies are done ex ante with no “true-up” capability. Similarly, they are based on efficient pricing models that only factor in short term risks – i.e., they have been designed based on the historical expectation that price regulation will be removed once effective competition is proven, rather than an expectation that these offerings will be available into perpetuity. Synergies provide some suggestions for retailers that might better enable these price setting processes to be redesigned to meet their current needs.

Next steps

The Synergies report highlights the need for retailers and policymakers to seek to better align the interests of retailers with the needs of customers, and to ensure that as the market continues to evolve, innovative approaches to managing debt are enabled.

In the coming months the AEC will seek to further engage with policymakers to ensure future market changes do not unreasonably inhibit the ability of retailers to remain viable. At the same time, we will investigate reform opportunities that increase the opportunities for customers to manage their own energy costs and use.

Related Analysis

OECD Price Comparison: How do we stack up?

As households and small businesses are notified of changes to their energy prices for the financial year, there continues to be scrutiny of our power prices. With energy affordability an ongoing concern for Australians, comparisons with overseas energy markets are common with consideration of how Australia's costs compare to other countries. We take a look at how our electricity prices stack up against other developed nations using the latest data across 38 OECD countries.

What’s behind the bill? Unpacking the cost components of household electricity bills

With ongoing scrutiny of household energy costs and more recently retail costs, it is timely to revisit the structure of electricity bills and the cost components that drive them. While price trends often attract public attention, the composition of a bill reflects a mix of wholesale market outcomes, regulated network charges, environmental policy costs, and retailer operating expenses. Understanding what goes into an energy bill helps make sense of why prices vary between regions and how default and market offers are set. We break down the main cost components of a typical residential electricity bill and look at how customers can use comparison tools to check if they’re on the right plan.

Principles-based regulations: What are the opportunities and trade-offs?

As Australia’s energy market continues to evolve, so do the approaches to its regulation. With consumers engaging in a wider range of products and services, regulators are exploring a shift from prescriptive, rules-based models to principles-based frameworks. Central to this discussion is the potential introduction of a “consumer duty” for retailers aimed at addressing future risks and supporting better outcomes. We take a closer look at the current consultations underway, unpack what principles-based regulation involves, and consider the opportunities and challenges it may bring.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.