The Consumer Data Right: What does it mean for the energy sector?

The consumer data right is coming. The implementation for the banking sector is fast approaching and energy will be next. What opportunities and challenges does this present for the industry?

Where did this idea come from?

The Federal Government asked the Productivity Commission to look into the benefits and costs of making public and private data sets more readily available as well as the ways consumers can benefit from access to data, particularly about themselves. In 2017, the Productivity Commission delivered its mammoth 600 page report that recommended a consumer data right (CDR) be rolled out across the economy.[1] It envisaged a staged approach with different sectors designated incrementally. The first is banking, to be followed by energy, then telcos.

These sectors will get tailored regulation that aims to empower consumers to direct their data to competitors or third parties to support competition and consumer choices and purchases. For electricity providers this is likely to be supported and accelerated by the installation of smart meters.

The Australian Competition and Consumer Commission (ACCC) will regulate the CDR once it’s up and running. The four big banks will have to comply with the first stage of the CDR by 1 July 2019.[2]

What is it?

The Consumer Data Right is all about competition. It is based on the idea of putting data collected by companies about their customers back into the hands of those consumers to drive competition between suppliers.

Every day we are creating data and companies are storing more and more of it. If companies find value in the data we create, it logically follows that consumers can find value in the data too – that’s the concept behind the CDR. Anyone who has applied to refinance their home loan or switch over their credit card knows it can be a time-consuming process. The CDR will make this process faster, easier and more accurate.

In the first stage, the CDR will allow you to authorise your banking information (spending, deposit and credit account information) to be pushed off to a competitor. That bank can then analyse that information and offer you products based on your actual banking information very quickly.

At a later stage, with a more mature CDR, we can imagine not just sending our data to get a quote but being able to do the whole switching process for all our banking, energy and phone contracts with a few taps on our phone. The CDR network will fill in all the forms for you, all you have to do is grant permission. In markets where customers who aren’t engaged often suffer ‘loyalty fees’ the CDR could have a huge effect on competition.

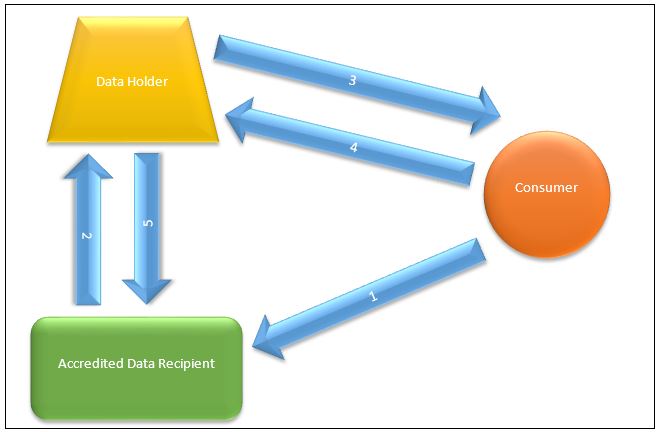

The ACCC in its recent consultation paper[3] breaks down how the CDR will work in practice (see figure 1).

1. The consumer will engage with an accredited data recipient. This could be a competitor, it could be a comparator website or it could be a totally different market that is accredited by the ACCC to receive that particular type of data.

2. The Accredited Data Recipient asks the Data Holder for the relevant data. At this stage the Data Holder will check the credentials of the Data Recipient.

3. The Data holder confirms the identity of the consumer who made the initial request.

4. The consumer authorises the Data Holder to give the data to the Accredited Data Recipient.

5. Finally, the data is shared to the Accredited Data Recipient for a specified purpose and a specified time (maximum 90 days)

Figure 1: How does it work?

Source: ACCC, Sept 2018

In practice, all of this will happen in the background, individuals will simply go online and access a CDR dashboard, they can then give the relevant authorisation and the network will take care of the rest. It will happen instantly and you could be provided with a tailored quote, service or product at the click of a button.

What data is being shared?

A designation instrument will specify what forms of data are to be considered ‘CDR Data’. The technical standards are still being developed and they will differ between industries. Once certain data sets are ‘designated’ data holders in a marketplace will have an obligation to provide that data set to accredited data recipients. An accreditation system will be established in each industry to determine who can validly receive designated data. While this scheme is young, it’s likely the accredited data recipients will be competitors or other businesses with closely related products. As the scheme matures, businesses with an indirect connection with the data might find ways of offering new products or services to consumers who choose to share their data with them. There will be enormous opportunities for entrepreneurs who find innovative ways to use data that can be released through the CDR.

CDR and Smart Meters

On the energy front, the amount of data being collected and stored about household and business electricity use is growing exponentially as smart meters are rolled out. As well as more information about our electricity usage, these meters enable new services such as remote meter reading, remote access to appliances and different pricing options. If you’ve got a smart meter, you can already go online and download data from your meter. What you can do with this data though, is quite limited and clunky.

With the CDR, specified data sets will be organised and updated continuously. These data sets will then be available to you at any time to release to an accredited data recipient. Initially these recipients might just be other electricity retailers, over time though, other businesses and industries might become accredited to receive your smart meter data and integrate services and technologies in ways that we’ve never seen before.

Retailers might be able to offer you special products that match your spending habits based on your credit card with your billing cycles to help you manage your finances. The CDR will set up the network so that these types of interactions can happen in the background. You will grant permission to access your data for a specified purpose and time, and you’ll be able to manager your permissions through an online dashboard.

Risks

To really unlock the benefits of the CDR it will be critical that security and privacy are front and centre as this data becomes more readily available on the marketplace. The Office of the Australian Information Commissioner will play an important enforcement role along with the ACCC. The CDR will also have its own set of privacy safeguards which are likely to be above current requirements under the Privacy Act 1988 (Cth). Ensuring that consumers know that when they engage with a CDR dashboard their data is secure and only being used for a specified purpose, will be critical to the success of the scheme and its uptake.

Where to next?

The CDR framework is being developed with three processes running in parallel. The Commonwealth Treasury department is developing the over-arching policy and the enabling legislation. The CSIRO’s Data 61 team are developing the technical standards for the scheme (these will determine the technicalities of how the data will be collected, stored and shared). The ACCC will play the lead regulator role, in charge of enforcement, and are developing the rules framework, with the Office of the Information Commissioner as sub-regulator. Due to this parallel process there are still lots of unanswered questions, but the CDR is rapidly taking shape and the energy industry is starting to prepare.

Conclusion

Putting consumers in control of their own data is a timely reform as more of our everyday lives are recorded in the cloud via an array of “smart” devices. AEMO’s CEO Audrey Zibelman has heralded the energy sector’s transition to a “fourth industrial revolution”[4] as every day technology becomes increasingly connected. We are likely to see new innovation and opportunities as well as risks. The CDR will be a powerful tool for both businesses and consumers as we move into Industry 4.0.

[1] https://www.pc.gov.au/inquiries/completed/data-access#report

[2] https://www.accc.gov.au/focus-areas/consumer-data-right

[3] https://www.accc.gov.au/focus-areas/consumer-data-right/accc-consultation-on-rules-framework

[4] http://energylive.aemo.com.au/News/Audrey-Zibelman-presenting-at-Paris-conference

Related Analysis

What’s behind the bill? Unpacking the cost components of household electricity bills

With ongoing scrutiny of household energy costs and more recently retail costs, it is timely to revisit the structure of electricity bills and the cost components that drive them. While price trends often attract public attention, the composition of a bill reflects a mix of wholesale market outcomes, regulated network charges, environmental policy costs, and retailer operating expenses. Understanding what goes into an energy bill helps make sense of why prices vary between regions and how default and market offers are set. We break down the main cost components of a typical residential electricity bill and look at how customers can use comparison tools to check if they’re on the right plan.

Principles-based regulations: What are the opportunities and trade-offs?

As Australia’s energy market continues to evolve, so do the approaches to its regulation. With consumers engaging in a wider range of products and services, regulators are exploring a shift from prescriptive, rules-based models to principles-based frameworks. Central to this discussion is the potential introduction of a “consumer duty” for retailers aimed at addressing future risks and supporting better outcomes. We take a closer look at the current consultations underway, unpack what principles-based regulation involves, and consider the opportunities and challenges it may bring.

Navigating Energy Consumer Reforms: What is the impact?

Both the Essential Services Commission (ESC) and Australian Energy Market Commission have recently unveiled consultation papers outlining reforms intended to alleviate the financial burden on energy consumers and further strengthen customer protections. These proposals range from bill crediting mechanisms, additional protections for customers on legacy contracts to the removal of additional fees and charges. We take a closer look at the reforms currently under consultation, examining how they might work in practice and the potential impact on consumers.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.