Tasmania: When it doesn't rain, it pours

A coincidence of events in Tasmania, with low rainfall causing low dam water storage levels resulting in decreased electricity generation from hydroelectricity and a fault in the Basslink interconnector, has led to wholesale prices surpassing $100 per megawatt hour ($/MWh) for the first time in over five years. The circumstances have also raised questions about the security of supply in the state. Below we take a look at the factors involved and the measures underway in response to the reduced supply.

Water levels

Tasmania experienced the eighth-driest year on record in 2015, partly due to the strong El Niño, according to the Bureau of Meteorology (BOM). The Tasmanian Energy Minister, Matthew Groom, has confirmed that water storage levels are projected to reach a low of about 14 per cent, assuming long-term average rainfall, towards the end of March or in early April 2016[i]. Dam storage levels are currently at 20 per cent.

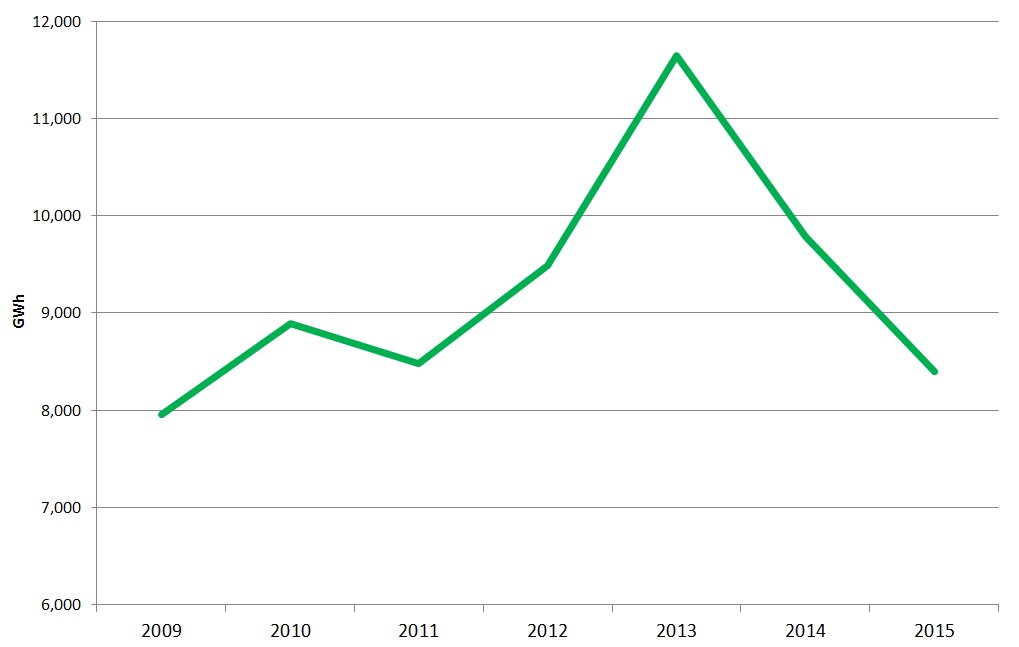

Hydroelectricity accounts for 74 per cent of Tasmania’s generation capacity, generating 87 per cent of Tasmania's electricity in 2013-14, according to the Electricity Gas Australia publication statistics[ii]. Based on the BOM’s annual summary the second half of 2013 was very wet, in contrast to 2015, when generation from hydro decreased due to the low rainfall as shown in Figure 1 below.

Figure 1: Tasmanian Hydro Generation – 2009-2015 [iii]

The introduction of the Federal Government’s carbon tax and high dam levels contributed to a significant increase in hydro output in 2012 and 2013. The abolition of carbon pricing on 1 July 2014 removed the additional incentive for low emissions generation that the market had seen since 1 July 2012 and has reduced the profitability of future hydro generation. Combined with that, the recent below average rainfalls have resulted in the lowest level of hydro generation since the 2008-09 droughts.

Basslink fault

The Basslink interconnector fault in the undersea power cable experienced on 20 December 2015 was detected about 100 kilometres off the Tasmanian coast and at a depth of about 80 metres. At the time of writing the cause of the fault was still being investigated. The importance of the interconnector is underlined by the fact that during late 2015, Tasmania had been importing about 40 per cent of the state's electricity needs from Victoria because of the low water storage levels in the state[iv].

Restoration of Basslink is expected to take up to nine weeks to complete, which would see it fully operational by the 19 March 2016[v].

Prices reach record highs in Tasmania

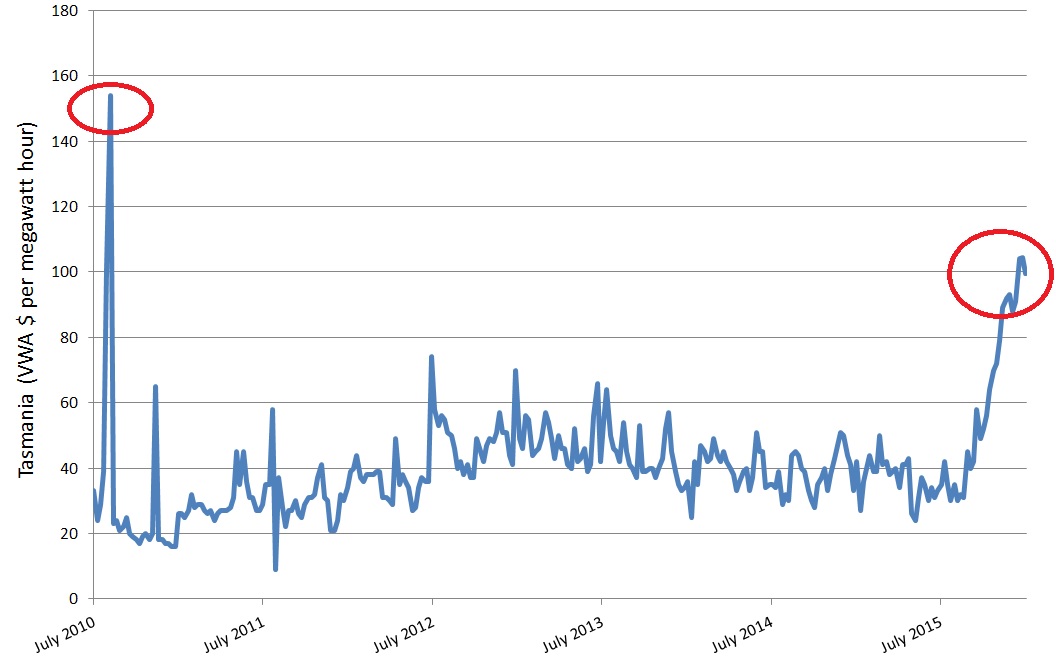

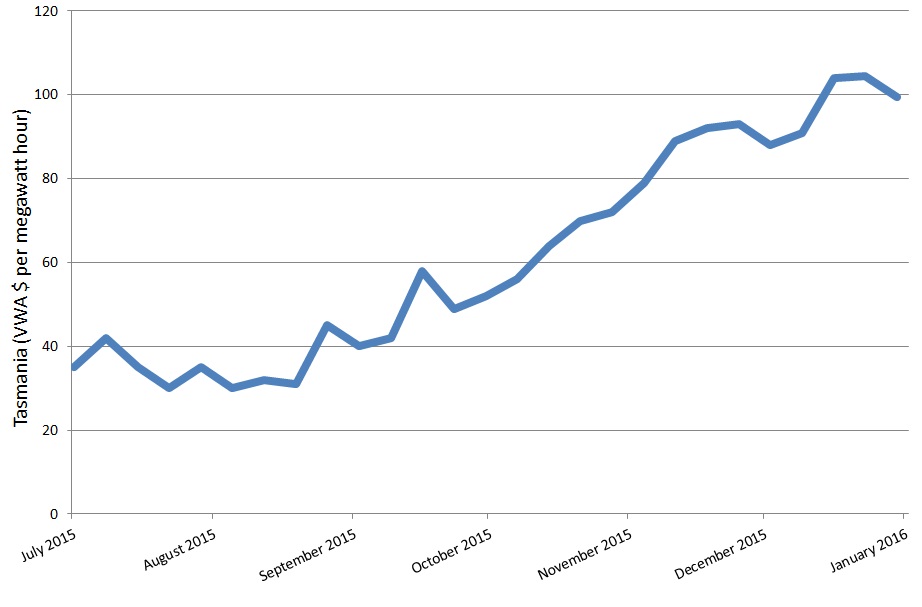

Last month Tasmania’s weekly volume weighted spot prices (VWP) surpassed $100/MWh. It was the first time the weekly VWP passed $100/MWh in Tasmania since 8 August 2010 when the weekly price reached $154/MWh. Figure 2 and 3 show the weekly VWP movements since 2010.

Figure 2: Weekly volume weighted average spot prices 2010-2015 – Tasmania[vi]

Figure 3: Weekly volume weighted average spot prices 2015 – Tasmania[vii]

It is important to note that under the Tasmanian wholesale contract regulatory framework, the Tasmanian Economic Regulator regulates electricity contracts that Hydro Tasmania has been required to offer for sale to other electricity market participants since 1 January 2014.

From 20 September 2015 to the end of December last year the weekly VWP has increased consistently. The higher than average prices have occurred because of scarce supply as a result of the low rainfall and interconnector issues.

Where to next?

After the driest September to November period on record in 2015, Hydro Tasmania announced the restart of the combined cycle gas turbine at the Tamar Valley Power Station. The CCGT was recommissioned on 20 January 2016. The unit had not generated power for more than 18 months[viii] and had been earmarked for sale. Hydro Tasmania had not used the CCGT while there was ample hydro generation and imports from Victoria were cheaper.[ix]

The CCGT remains a commercially sensible addition in the short-term to the Tasmanian energy supply mix. The sale of the unit is currently off the table with the State Government withdrawing its previous approval following the failure of Basslink. The future of the unit will now be reviewed[x].

Despite the current situation, the State Government and Hydro Tasmania have indicated that under normal operating circumstances, there is enough energy to meet Tasmanian demand through the combination of future hydropower inflows, wind generation and the import capacity of Basslink, which is expected to come back to full capacity by late March 2016.

Tasmania has diversified its energy mix with the inclusion of wind in addition to gas and hydro energy. Currently there is 308 MW of large-scale wind connected. This could increase in coming years with over 700 MW of proposed wind capacity[xi] from a range of private developers.

[i] Tasmanian Premier Will Hodgman, Media Release 14 January, http://www.premier.tas.gov.au/releases/basslink2

[ii] ESAA, Electricity Gas Australia 2015

[iii] Source: NEM Review , Data: Metered Generation

[iv] ABC News article, 2015, Hydro Tasmania to fire up Tamar Valley Power Station in 2016, http://www.abc.net.au/news/2015-12-16/hydro-tasmania-to-fire-up-tamar-valley-power-station-in-2016/7034550

[v] Basslink, 2015, Basslink interconnector update, http://www.hydro.com.au/system/files/documents/Basslink/Basslink_Media_statement_140116.docx_.pdf

[vi] Source: NEM Review/ Australian Energy Regulator (AER)

[vii] Source: NEM Review/ Australian Energy Regulator (AER)

[viii] Hydro Tasmania media, 2015, Hydro Tasmania to restart combined cycle gas turbine, http://www.hydro.com.au/about-us/news/2015-12/hydro-tasmania-restart-combined-cycle-gas-turbine

[ix] Hydro Tasmania media, 2015, Changes to operation of Tamar Valley Power Station, http://www.hydro.com.au/about-us/news/2015-08/changes-operation-tamar-valley-power-station

[x] Tasmanian Government, 2016, Response to the Tasmanian Small Business Council, http://www.premier.tas.gov.au/releases/response_to_the_tasmanian_small_business_council

[xi] ESAA, Electricity Gas Australia, 2015

Related Analysis

Consumer Energy Resources: The next big thing?

The Consumer Energy Resources Roadmap has just been endorsed by Energy and Climate Change Ministers. It is considered by government to be the next big reform for the energy system and important to achieving the AEMO’s Integrated System Plan (ISP). Energy Minister, Chris Bowen, recognises the key will be “making sure that those consumers who have solar panels or a battery or an electric vehicle are able to get maximum benefit out of it for themselves and also for the grid”. There’s no doubt that will be important; equally there is no doubt that it is not simple to achieve, nor a certainty. With the grid intended to serve customers, not the other way around, customer interests will need to be front and centre as the roadmap is rolled out. We take a look.

Australia’s workforce shortage: A potential obstacle on the road to net zero

Australia is no stranger to ambitious climate policies. In 2022, the Labor party campaigned on transitioning Australia’s grid to 82 per cent renewable energy by 2030, and earlier this year, Prime Minister Anthony Albanese unveiled the Future Made in Australia agenda, a project which aims to create new jobs and opportunities as we move towards a net zero future. While these policies have unveiled a raft of opportunities, they have also highlighted a major problem: a lack of skilled workers. Why is this a problem? We take a closer look.

Made in Australia: The Solar Challenge

While Australia is seeking to support a domestic solar industry through policy measures one constant question is how Australia can hope to compete with China? Australia currently manufactures around one per cent of the solar panels installed across the country. Recent reports and analysis highlight the scale of the challenge in trying to develop homegrown solar manufacturing, as does the example of the US, which has been looking to support its own capabilities while introducing measures to also restrict Chinese imports. We take a look.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.