SA pioneering Australia’s energy transformation

The operation of a relatively isolated, high intermittent generation grid in South Australia is revealing new challenges about how we will need to manage these systems in the future. To date seven impacts or risks have been identified from this evolving system:

- Increased spot price volatility

- Increased contract price for baseload generation

- Accelerated retirement of firm generators leading to peak capacity concerns

- Tight domestic gas markets aggravate already marginal operating conditions for firm gas generators in high intermittent operational conditions

- Increased power quality risks during periods of low demand

- Possibility that minimum demand could be met entirely by unscheduled intermittent generation (e.g. rooftop solar PV generation) by as early as 2023

- Reduced system responsiveness to sudden losses of generation.

The energy industry has been investigating some of the potential ramifications and challenges of these new operating conditions. The Australian Energy Council has commissioned three reports from independent expert analysts that look at different aspects of electricity supply in South Australia. We have also written a covering paper that brings all the analysis together and proposes areas for further investigation.

In December 2015 Deloitte reported to the Energy Supply Association of Australia on the consequences of deteriorating returns for conventional generation in increased intermittent generation systems. Deloitte warned that South Australia may have insufficient capacity to meet peak demand events, although this was prior to the reversal of planned mothballing of gas fired capacity. It also observed that market conditions in South Australia did not support investment in new flexible gas fired generation.

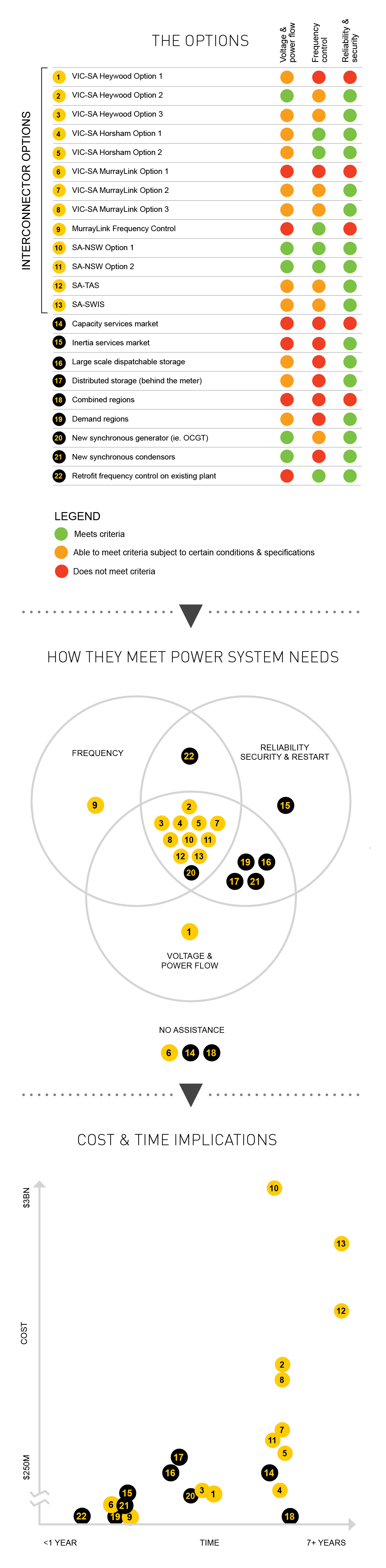

In September 2016 ACIL Allen was commissioned by the Australian Energy Council to explore a range of possible solutions to improve power quality in South Australia. They found that some proposed interconnector options could be effective in addressing a range of technical issues, but they are either very expensive or have long lead times, or both. A combination of lower cost options to procure incremental inertia, frequency and voltage control and additional dispatchable capacity could collectively provide a quicker outcome. The challenge would be to do so without undermining overall investment signals.

Figure 1: Solutions to high renewable integration in South Australia, ACIL Allen 2016 (View larger version of the diagram)

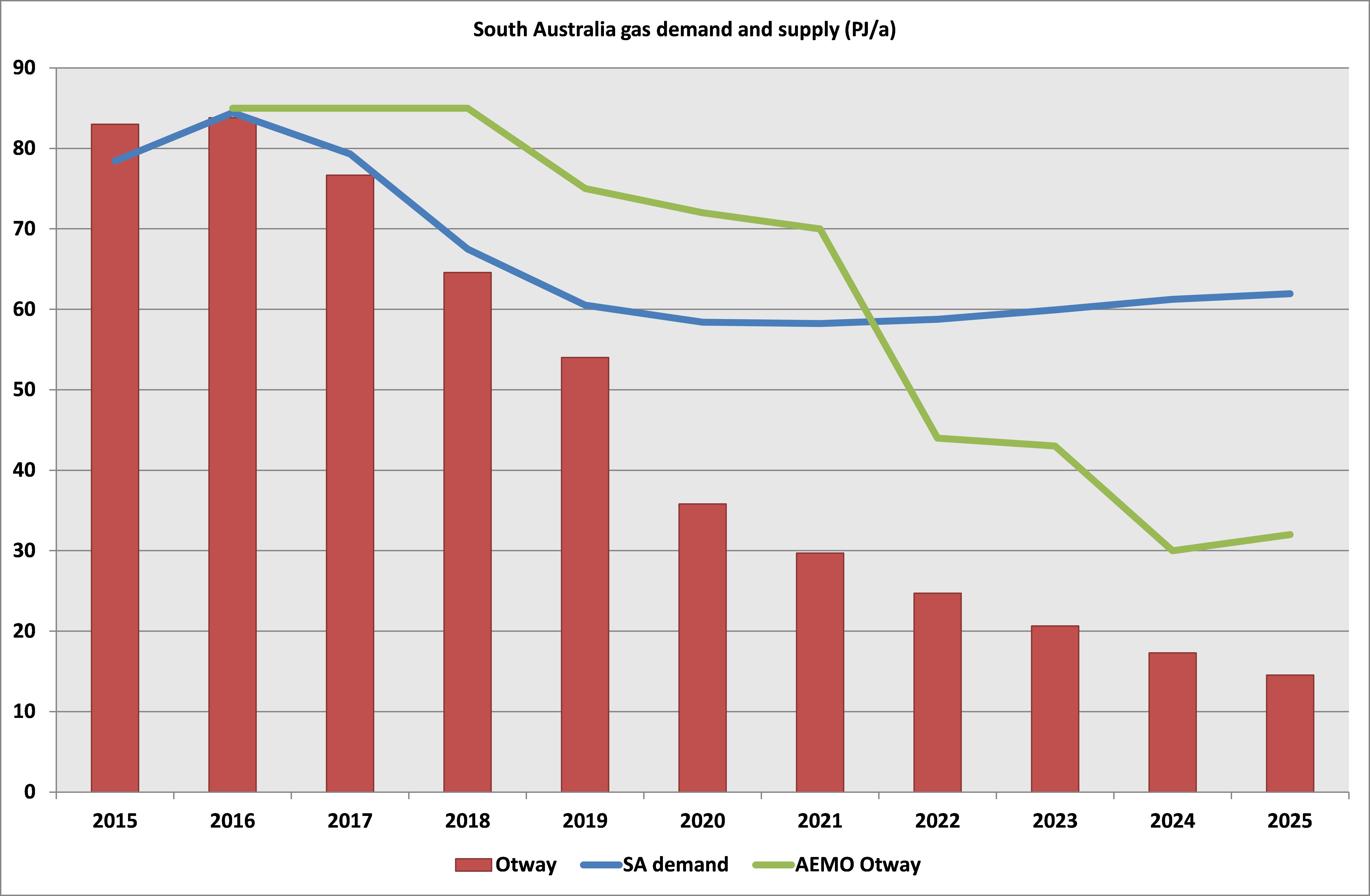

In July 2016 EnergyQuest examined the impact of natural gas supply on South Australian electricity generators, given the importance of gas as a fuel for reliable electricity supply in South Australia. They found that the South Australian gas market could be short by 2019, as the result of a growing domestic supply gap in the southern states over the next decade. This does not necessarily preclude gas being available to back-up intermittent renewables but it would imply high gas prices and difficulty in contracting more generally.

Figure 2: South Australian gas supply and demand PJ/annum

Source: AEMO, EnergyQuest: 2015 numbers are actuals

Further matters for investigation

Matters for investigation include:

- Improved design of renewable support schemes that account for their impact on the system;

- More tools for the market operator (AEMO) to procure contingent support in advance of threats to power system security

- Whether market structures need redesign to provide long-term signals for the right mix of services

- How to elicit greater demand flexibility.

Ultimately, these potential enhancements to the energy market and regulatory settings will still need to be underpinned by an enduring (i.e, bipartisan), stable and integrated climate and energy policy framework.

Related Analysis

Certificate schemes – good for governments, but what about customers?

Retailer certificate schemes have been growing in popularity in recent years as a policy mechanism to help deliver the energy transition. The report puts forward some recommendations on how to improve the efficiency of these schemes. It also includes a deeper dive into the Victorian Energy Upgrades program and South Australian Retailer Energy Productivity Scheme.

The return of Trump: What does it mean for Australia’s 2035 target?

Donald Trump’s decisive election win has given him a mandate to enact sweeping policy changes, including in the energy sector, potentially altering the US’s energy landscape. His proposals, which include halting offshore wind projects, withdrawing the US from the Paris Climate Agreement and dismantling the Inflation Reduction Act (IRA), could have a knock-on effect across the globe, as countries try to navigate a path towards net zero. So, what are his policies, and what do they mean for Australia’s own emission reduction targets? We take a look.

UK looks to revitalise its offshore wind sector

Last year, the UK’s offshore wind ambitions were setback when its renewable auction – Allocation Round 5 or AR5 – failed to attract any new offshore projects, a first for what had been a successful Contracts for Difference scheme. Now the UK Government has boosted the strike price for its current auction and boosted the overall budget for offshore projects. Will it succeed? We take a look.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.