New market structure emerging review finds

The latest Australian Energy Market Commission’s retail competition review has highlighted the emergence of a new market structure as market concentration continued to fall during the past year.

The review was also notable for being the last before the re-introduction of price regulation in in the form of the Default Market Offer and the Victorian Default Offer. Future reports will be able to assess whether the regulatory changes have benefited consumers.

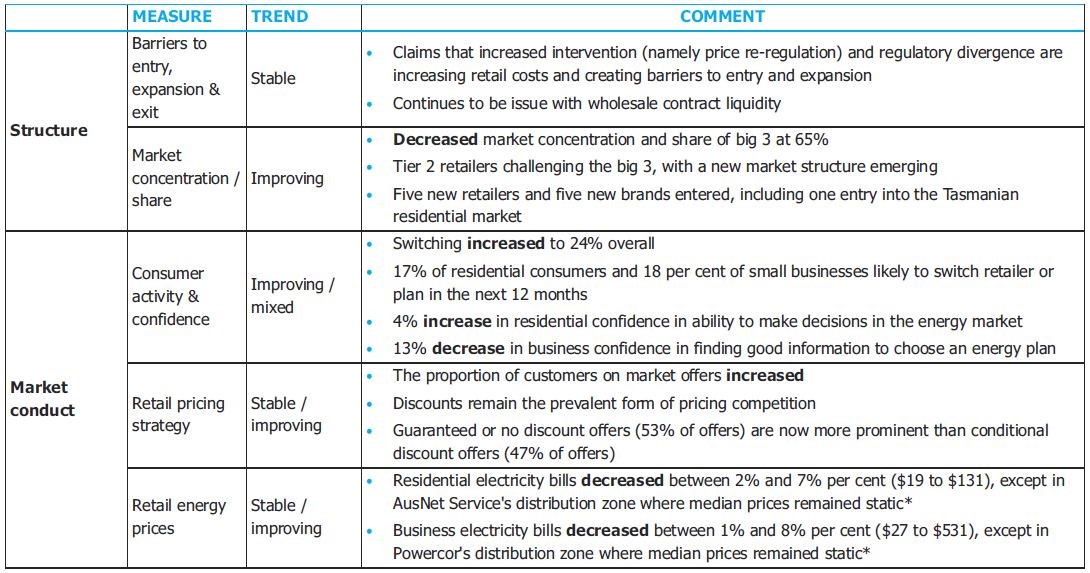

The commission’s work flags some positive outcomes as well as overall market measures and trends during the year (which are shown in the summary table below). Some of the positive developments it highlights are:

- Outcomes for consumers on contestable markets improved.

- Increased competition led to decreases in prices and market concentration everywhere but in Tasmania.

- New and emerging retailers are driving lower prices and the market is starting to shift towards simpler and more comparable price structures and greater product innovation.

Summary of measures and indicators

Pricing

The market has shifted towards simpler and more stable priced offers. There was an increase in the number and proportion of simply priced products available and the percentage of offers without conditional discounts rose 10 per cent across the NEM. There was also an increase in the number of percentage of fixed or capped price offers.

Retail prices generally decreased over the past year:

- Median standing offers fell in all deregulated jurisdictions with SEQ enjoying the biggest fall (4 per cent).

- Market offers generally fell more than standing offers across deregulated jurisdictions, so there continues to be significant opportunities for consumers to save by shopping around.

- The percentage of customers on standing offers continued to fall and at December last year there were 6 per cent of customers on standing offers in Victoria, 9 per cent in SA, 14 per cent in NSW and 15 per cent in SEQ.

Improvements

The AEMC has also identified improvements in structural competitive metrics in the past 12 months, including:

- An increase in the number of competitors with five new retail brands emerging and five existing brands expanding into new jurisdictions. There are now 38/33 retail brands and companies in the National Electricity Market.

- Switching rates are up and reached a record high of 24.4 per cent in the NEM. The greatest increase is in switching from the so-called “big 3”[i] (AGL, Origin and EnergyAustralia) to tier 2 retailers. With the switching and drop in concentration, for the first time, the “big 3” retailers no longer hold the three largest market shares in SEQ and South Australia.

- Market concentration decreased in all NEM jurisdictions, except Tasmania, and the decrease was the largest recorded in the past 10 years in Victoria and the ACT, while it was the second highest reported for South East Queensland (SEQ).

Despite all this a note of caution was raised via the commission’s retailer survey and interviews. Retailers consider that barriers to entry and expansion in the market are likely to increase in future with new and emerging retailers pointing to the regulated cap on standing offers decreasing product innovation and switching, which will make it harder for new and emerging retailers to enter and or expand. As noted, this will be able to be tested in future reviews.

A new market structure emerging

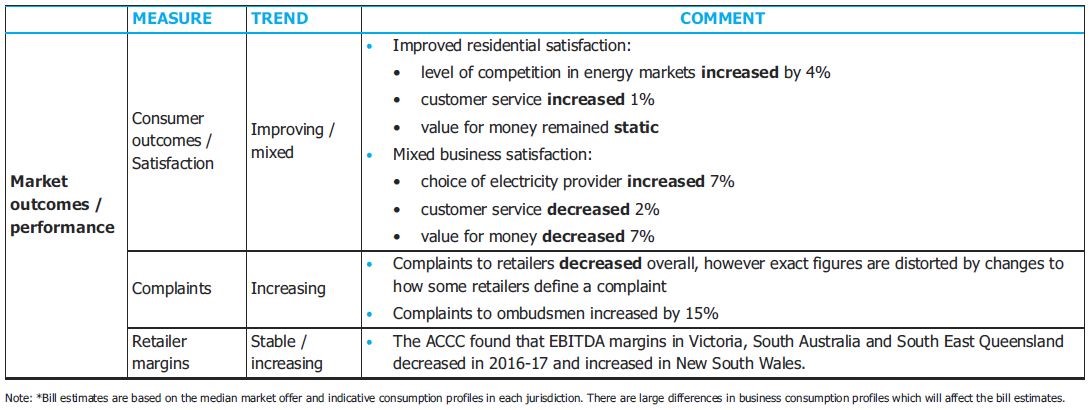

The new market structure that has emerged is made up of three types of retailers (see figure 1 below), categorised by the commission as:

- Incumbent retailers – the retailer that purchased the customer base at the time of deregulation

- Tier 1 retailers – retailers who hold more than a 10 per cent market share and who are typically vertically integrated. Together they now hold around 55 per cent of the total market share.

- Tier 2 retailers – these are the remaining retailers who collectively hold as much as 13 per cent of the market share now.

Figure 1: Emerging retail electricity market structure

Source: AEMC. * AGL, EnergyAustralia (EA) and Origin Energy are considered a tier 1 retailer in those network regions where it is not an incumbent retailer. Origin Energy is the incumbent retailer for Citipower, Powercor, Essential Energy, Endeavour Energy and Energex network regions. AGL is the incumbent retailer for United Energy, Jemena, Energex and SA Power Networks network regions. EA is the incumbent retailer for AusNet Services and Ausgrid network regions.

To better analyse and understand this emerging market structure, the commission has now recommended that the Australian Energy Regulator require retailers to provide data on customer numbers and the type of offers they are on by each network region.

Market share and market concentration

A shifting dynamic in the market share of both vertically integrated and standalone retailers (these categories are further explained below) was identified by the commission’s review. Until recently vertically integrated retailers (explained further below) were limited to the big 3, but as shown in figure 3 that has now broadened to include more retailers. Retailers in the AEMC’s survey noted the market structure has moved from a big 3 to a “big 5/6”.

Since retail contestability incumbent retailers have progressively lost their significant market share to other retailers. While initially this involved one of the big 3 entering network regions to compete against an incumbent, smaller retailers have since been entering and the most successful of these were or have become vertically integrated.

The review notes that while analysis of market share shows the three incumbent retailer continuing to have the biggest slice of the market, now the three largest in some network regions are no longer just the big 3, which the AEMC comments represents a “significant shift in the retail electricity market structure” and appears to be fundamentally changing the way in which these jurisdictional markets operate.

Apart from the decreasing market concentration the review points to recent examples to illustrate how it sees competition actually improving in the NEM. These include:

- The entry and expansion of Alinta Enrgy into the SEQ

- Tango Energy’s entry into the small customer segment in Victoria

- Powershop’s expansion into SA and its offering of demand response to lower bills

- A general shift from discounting practices and retailers noting consumers’ preference for simpler and more stable pricing.

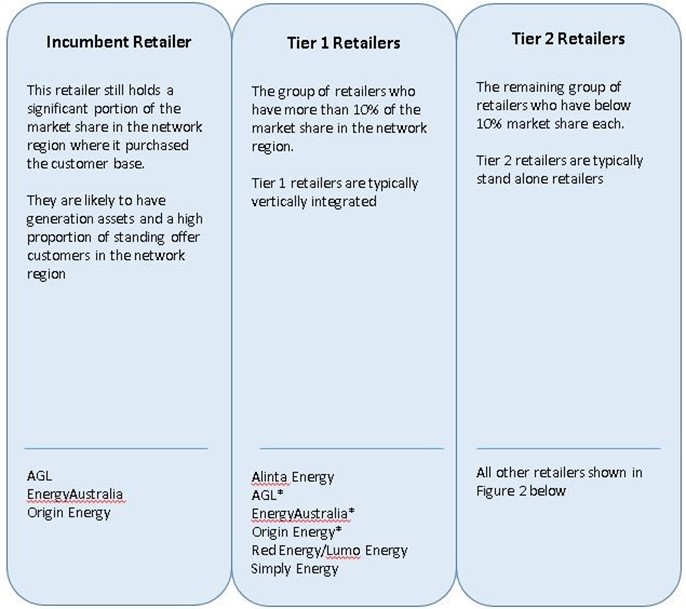

The review also notes the rate of shifting between the big 3 and from tier 2 to the big 3 provides an insight into how effectively the incumbent retailers are competing. Figure 2 shows how overall switching continued to increase in 2018 with switching from the big 3 to tier 2 retailers continuing to increase significantly (particularly evident in SEQ where Alinta entered the market). Generally switching between tier 2 retailers is also on the rise.

The review notes that consumer switching between retailer types shows the changing market dynamics in the electricity market structure.

Figure 2: Consumer switching within and between retailer tiers, 2012-2018

Source: AEMO, AEMC analysis

Source: AEMO, AEMC analysis

The retailer models

When assessing retailer models the AEMC splits them into two main groups based on their business structure – vertically integrated and standalone retailers – as well as their ownership structure (figure 3).

Vertical integration

Vertically integrated retailers are part of a business that owns generating assets, as well as retail customers. This model provides a means for retailers and generators to internally manage the risk of price volatility in the wholesale market. The trend of retailers to vertically integrate continued in 2018 and the commission notes that in its retailer surveys and interviews some form of vertical integration “is becoming a prerequisite to be able to expand to an efficient scale”.

It also notes that some retailers are vertically integrated through an arms-length relationship, so still have access to wholesale hedging contracts through the parent company that owns or is a generation business.

Figure 3: Structure of electricity retail businesses in the NEM

Source: AEMC. * A retail business that is ‘at arms length’ from their parent business who owns, or is, a generation business.

Standalone retailers

These typically contract with external parties for their whole risk management portfolio. Typically they have a higher cost to serve due to a larger number of derivative contracts they have to purchase to hedge their load.

Conclusion

The AEMC’s latest review is a useful and timely reminder that competition has brought results and encouraged new entrants, it will be interesting to note the impact that recent regulatory changes, such as the introduction of default price caps will have on the emerging market structure and level of activity.

[i] The AEMC states that the big 3 have traditionally held significant market share because the businesses are the incumbent retailer – the business that purchased the retail customer base at privatisation – for at least two network regions.

Related Analysis

Data Centres and Energy Demand – What’s Needed?

The growth in data centres brings with it increased energy demands and as a result the use of power has become the number one issue for their operators globally. Australia is seen as a country that will continue to see growth in data centres and Morgan Stanley Research has taken a detailed look at both the anticipated growth in data centres in Australia and what it might mean for our grid. We take a closer look.

Green certification key to Government’s climate ambitions

The energy transition is creating surging corporate demand, both domestically and internationally, for renewable electricity. But with growing scrutiny towards greenwashing, it is critical all green electricity claims are verifiable and credible. The Federal Government has designed a policy to perform this function but in recent months the timing of its implementation has come under some doubt. We take a closer look.

Energy regulation: A tale of increasing overload?

The energy sector is seeing an increase in regulation, with the retail laws and rules seemingly being changed year on year. This has led to old, overlapping or obsolete regulation not being removed, making it difficult for retailers to comply with, and regulators to enforce these rules and laws. We take a look at how overregulation is affecting customers and the cost of electricity.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.