Default Market Offer: Missing the mark in 2020-21

On 30 April 2020 the Australian Energy Regulator (AER) released its updated Default Market Offer (DMO) prices for 2020-21. The DMO prices apply to residential and small business customers on standing offers in the non-price regulated jurisdictions of New South Wales, South-Eastern Queensland and South Australia. The DMO is the maximum price retailers can charge electricity customers on standing offers in each distribution network region. It also acts as a reference price that retailers must use when advertising or promoting offers. The AER’s Final Determination concluded that DMO prices were decreasing for most customer types, across all networks. Its media release stated:

“This year customers will see DMO prices decrease significantly or remain similar in comparison to last year’s DMO, depending on the region.”[i]

It now appears that the DMO for 2020-21 is not an accurate reflection of the costs retailers will face in 2020-21. The DMO prices for each year are calculated by the AER based on an indexed assessment of changes in wholesale energy costs, environmental costs, network charges and retail costs from the previous year. Industry is broadly supportive of this approach. But a lot has changed since the Final Determination was published on 30 April, and with the benefit of hindsight we can now see that the DMO has not accurately captured the changes in retailer costs.

This is because the AER:

- underestimated network costs, using indicative, rather than actual network charges which were higher;

- indexed the change in cost of the Small-scale Renewable Energy Scheme (SRES) based on updated information for 2019-20, rather than the estimated costs included in the 2019/20 DMO;

- averaged the cost of the ancillary services across all customers in the National Electricity Market (NEM), even though these costs are specific to jurisdictions, so can vary substantially; and,

- did not make any allowance for the impact on retailers of dealing with COVID-19, particularly in relation to bad debt.

Why does this matter? It matters because a DMO that is set too low can damage competition as it impacts a retailer’s ability to price competitively and below it – and this may have particular implications for smaller retailers that may be struggling to recover their costs. It additionally may have flow-on effects for those retailers whose market contracts are linked to the DMO and who strive to ensure that no market customer pays more than the DMO price.

The DMO also helps set community expectations about whether energy prices across the market are going to increase or decrease – ideally it should send a message consistent with that sent by retailers – rather than create a false expectation that prices are decreasing.

Background

The DMO was introduced on 1 July 2019. It is designed to provide an adequate safety net for disengaged customers while still encouraging retail innovation and customer participation in the market. It is in effect a ‘fallback for those who are not engaged in the market and should not be a low-priced alternative to a market offer’[ii]. While not intended to be a precise assessment of a retailers’ cost stack, to the extent possible, year-on-year changes should be representative of actual retailer costs.

There were some differences of opinion about the AER’s approach to setting the DMO in its first year 2019-20. The AEC supports the index approach adopted by the AER which ensures that the DMO is able to deliver on its objectives of reducing the costs paid by the most disengaged energy customers, without risking the benefits that engaged customers are able to obtain from choosing a market deal that suits their needs. This is preferred to the alternative of a bottom-up approach, which carries inherent risks. This is because the cost stack methodology needed for a bottom-up assessment creates unnecessary risks, as it requires a precise assessment of each element of the cost stack, without delivering any material benefits when considered against the policy objectives of the DMO.

Some discrepencies

Many of the inaccurate inputs used for the 2020-21 DMO result from a lack of reliable cost information at the time of setting it, coupled with the challenges regulators experience in forecasting reasonable costs, which is an inherent challenge in any price setting process. Below we take a closer look at examples of costs that have not been accurately reflected:

Network costs

The ACCC’s Retail Electricity Pricing Inquiry (REPI) found that network costs make up about 48 per cent of a residential electricity bill [iii]. The REPI goes on to explain that network costs represent the largest component of an electricity bill and had been the primary driver of higher bills over the past decade studied [iv]. It is critical then that network costs are calculated as accurately as possible when setting the DMO. If network costs are undervalued, it impacts a retailer’s ability to price its competitive market offers below it (as noted above particularly smaller retailers) and this in turn will reduce the incentives for customers to engage in the market.

Unfortunately, the AER was unable to incorporate the current actual changes into the DMO because of the timing of the finalisation of network tariffs. Under the Electricity Retail Code (the Code), the AER is required to release its DMO decision no later than 1 May each year, before the AER is required to approve network costs for the coming year.

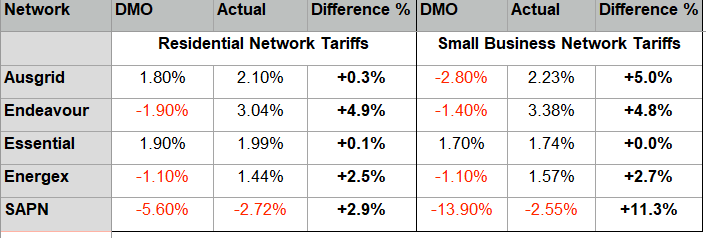

To take account of this, the AER instead used indicative network charges from earlier regulatory proposals. Now that the AER has approved network prices for 2020-21, it is possible to see how the indicative costs vary when compared to the actual network charges for 2020-21.

The table below uses the AER’s published average consumption data to show how significant the variances are. In each network distribution area they are understated in the DMO.

Actual Network Charges Vs DMO Assumptions

Source: Analysis of AER data

Source: Analysis of AER data

These material errors may have been avoidable. A better approach might have been for the AER to use network tariffs for 2020-21 that are consistent with how the DMO was calculated. Any under or over recovery of allowed revenue for the networks could then be “trued-up” in future years.

Alternatively, the Government could push back the DMO commencement date (with a small adjustment for lost revenue to be made) so finalised network tariffs could be incorporated.

If an alternative method of setting network costs is not introduced and the current approach continued, then there is the potential for material inaccuracies in every DMO calculation. To mitigate against this, if it is continuing with the status quo then the AER should consider setting the DMO with great caution, to avoid setting a price that is too low and places an unreasonable risk on retailers. The AEC would support indexing the draft network costs as a potential way to achieve this.

COVID-19 Implications

It is clear that the impact of COVID-19 has resulted in an increased cost of doing business for retailers, as they work to support customers in difficult circumstances. These increased costs are due to a range of factors, including:

- the requirement for staff to work from home, with accompanying operational and technical challenges;

- in the early stages of the pandemic some international call centres experienced closures, necessitating a ramp up of onshore services at a significant cost;

- there will likely be a large increase in bad and doubtful debts as a result of more customers experiencing financial vulnerability and the disconnection limitations in the AER’s Statement of Expectations;

- the difficulty in completing energy efficiency activities, given business closures and social distancing requirements. This in turn affects the supply of certificates, which will likely result in higher certificate prices and higher compliance costs being imposed on retailers;

- Government and industry relief packages, whilst useful in their support for customers, do carry a cost of delivery for retailers, which serve as the customer-facing actor; and,

increased obligations to provide support to customers, particularly small business customers.

Although the AER was put in a difficult position with the timing of COVID-19, it is disappointing that the DMO for 2020-21 does not take anticipate any additional costs as a result of it. As the industry grapples with the fallout of the pandemic, its actual impact will become clearer. In the meantime, it is reasonable to assume that the recession will continue to impact customers and their retailers for months to come. The industry is keen to work with the AER to ensure that those costs can be captured accurately and incorporated into the 2021-22 DMO (or considered as part of a re-opening of the 2020-21 Final Determination).

Conclusion

The industry understands that there are real challenges in attempting to forecast retail price inputs in an ever-changing environment. Although the DMO was never designed to be a bottom up, precise calculation (as in historical price regulation processes), it is still important that it is broadly accurate, avoids material miscalculations and gives customers a fair indication of what they can expect from either their market or standing offer contract prices.

There are options available to the AER that might help ameliorate the timing issues it faces. It would be worthwhile considering either indexing the revised proposed network costs or allowing for a network price risk allowance in future DMO calculations. This would allow retailers to recover any undervaluing and ensure continued customer engagement in the market – given the policy objectives of the DMO, the risks of setting the price too low are greater than the risks that come from setting the price slightly too high.

It may also be open to the AER to consider a re-opening of the Final Determination for the DMO 2020-21. This opportunity is found in section 17(4)(b) of the Code, which provides that the AER can issue a new determination if “the only effect of the new determination is to correct minor or technical errors in the previous determination”. This would seem to be the case, at least in respect of network pricing.

It is unfortunate that the 2020-21 DMO does not enable cost recovery by retailers and seems inconsistent with the spirit of other AER initiatives designed to support both customers and the ongoing viability of retailers. A resilient and competitive retail market is to the benefit of customers and industry alike, but these outcomes cannot occur unless the regulatory framework is set up to accurately assess input costs.

The AEC and its members are keen to continue to work with the AER to ensure the DMO is set in a manner that provides retailers and customers with some certainty during the challenging year ahead. The DMO plays an important role as a reasonably priced safety net for customers who do not engage with the market. But care must be taken to ensure that it does not detract from the benefits of the competitive market.

[i] Default Market Offer continues to protect disengaged energy customers, AER Media Release, 30 April 2020

[ii] Australian Energy Regulator, ‘Draft Determination: Default Market Offer Prices 2020-2021’, February 2020, p29.

[iii] Australian Competition & Consumer Commission, ‘Retail Electricity Pricing Inquiry’, 2017, Commonwealth of Australia, p6.

[iv] Ibid. The decade studied was 2007-2008 to 2015-2016.

Related Analysis

A New Year: New regulated offer; new records but some old challenges

A new year has brought major developments across Australia’s energy markets, with new regulatory interventions alongside record-breaking renewable generation. The Federal Government’s Solar Sharer Offer marks a significant shift in retail market design, while the wholesale market delivered historic renewable output and much lower prices, driven largely by strong wind and growing battery capacity. We take a look at what these changes mean for customers, retailers and the reliability of the power system, and where old challenges continue to resurface.

2025 Another Year Full of Energy (Developments)

2025 has been another year in which energy-related issues have been front and centre. It ended with a flurry of announcements and releases, including a new Solar Sharer tariff proposed by the Federal Government and the release of the 2026 Integrated System Plan (ISP) draft. Below we highlight some of the more notable developments over the past 12 months.

Getting it right: How to make the “Solar Sharer” work for everyone

On paper, the government’s proposed "Solar Sharer Offer" (SSO) sounds like the kind of policy win that everyone should cheer for. The pitch is delightful: Australia has too much solar power in the middle of the day; the grid is literally overflowing with sunshine: let’s give households free energy during 11am and 2pm. But as the economist Milton Friedman famously warned, "There is no such thing as a free lunch." Here is a no-nonsense guide to making the SSO work.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.