Deciphering the ISP

On 17 July the Australian Energy Market Operator (AEMO) released its Integrated System Plan (ISP) and soon after EnergyInsider had a look at transmission planning principles (Building Transmission In A Market). Now we get into the detail of the 100-page report and decipher what it tells us.

Generation Changes

Recommendation 5.1 of the Finkel Review[i] was for AEMO to prepare an ISP “to facilitate the efficient development and connection of renewable energy zones across the National Electricity Market”. The ISP effectively replaces the National Transmission Network Development Plan (NTNDP) which performed a similar, “independent, strategic view of the efficient development of the NEM transmission grid over a 20-year planning horizon”.[ii] Unlike the restricted focus of state-based transmission planners, the ISP (as the NTNDP did before it) seeks to assess the NEM’s needs holistically.

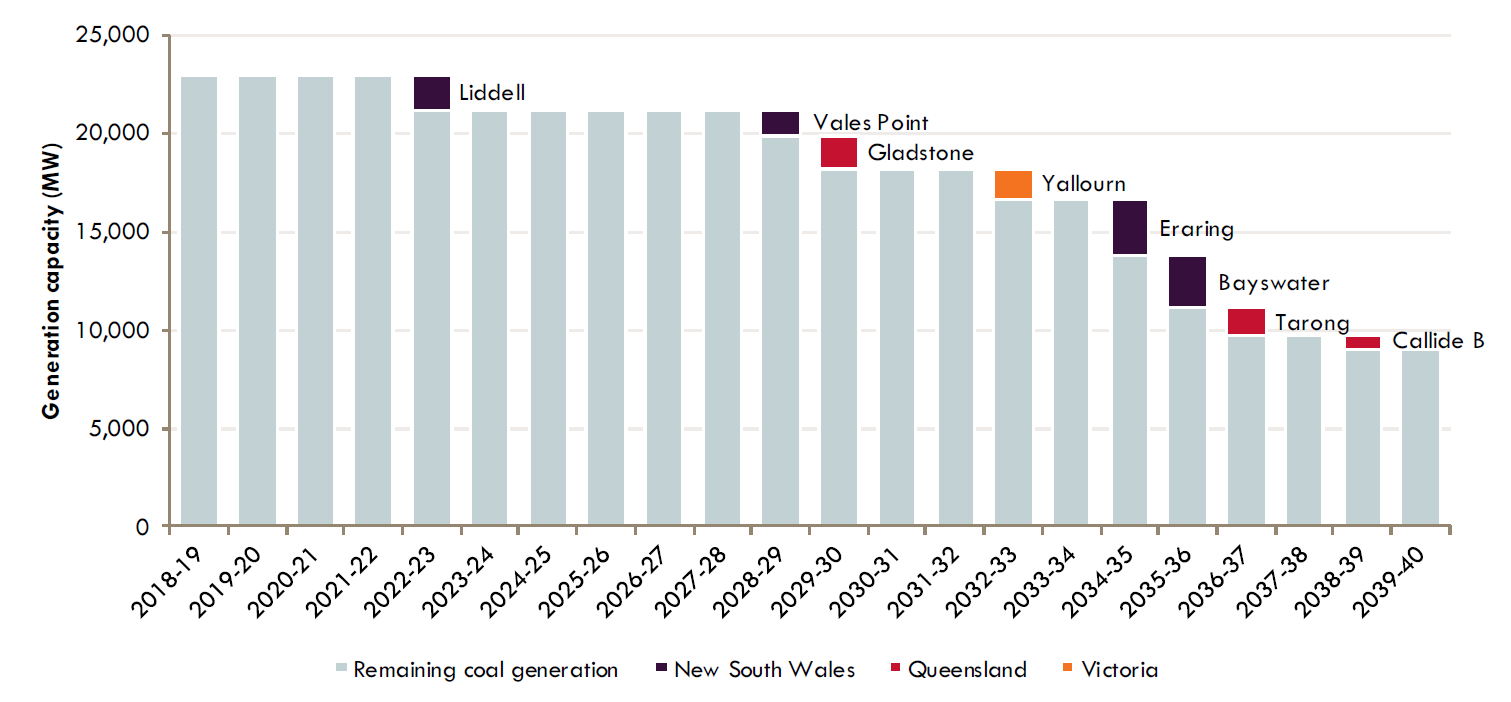

The ISP considers the power system’s transition as a result of coal-fired generation retiring, the construction of new renewable generation, and changes in operational demand as a result of economic conditions, energy efficiency and distributed energy resource penetration. AEMO’s assumptions about coal-fired generation capacity are shown in the following graph.

Figure 1: NEM coal-fired generation fleet operating life to 2040

Source: AEMO, ISP, Figure 2, p.22

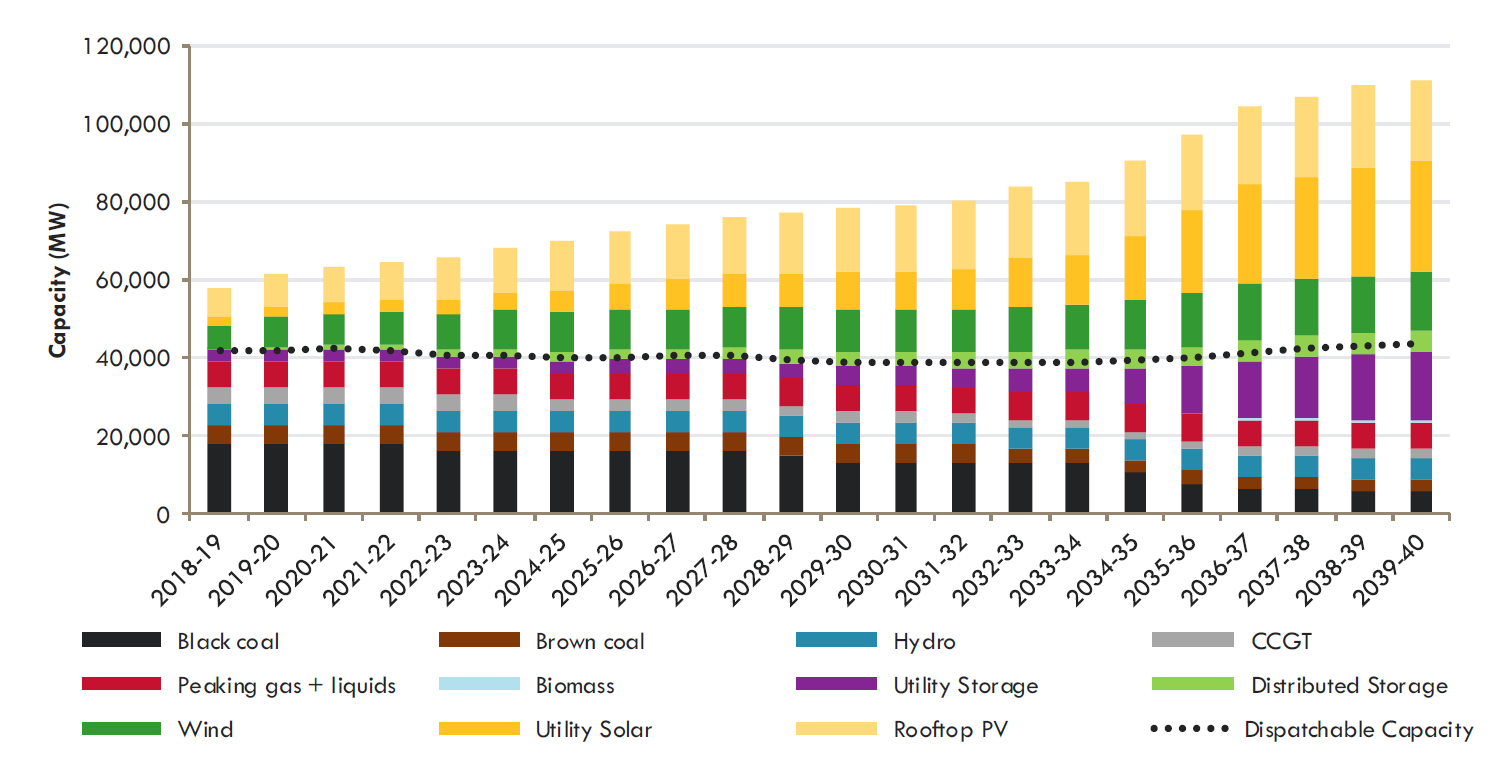

The neutral case reports that dispatchable capacity will remain fairly constant at about 40GW, with much of the retiring black and brown coal plant capacity taken up by storage increasing to 17GW (90GWh). Wind capacity will increase by about 10.5GW, while the major growth will be from 28GW of utility scale solar, as shown in figure 2.

Figure 2: Forecast NEM generation capacity in the Neutral case

Source: AEMO, ISP, Figure 9, p.37

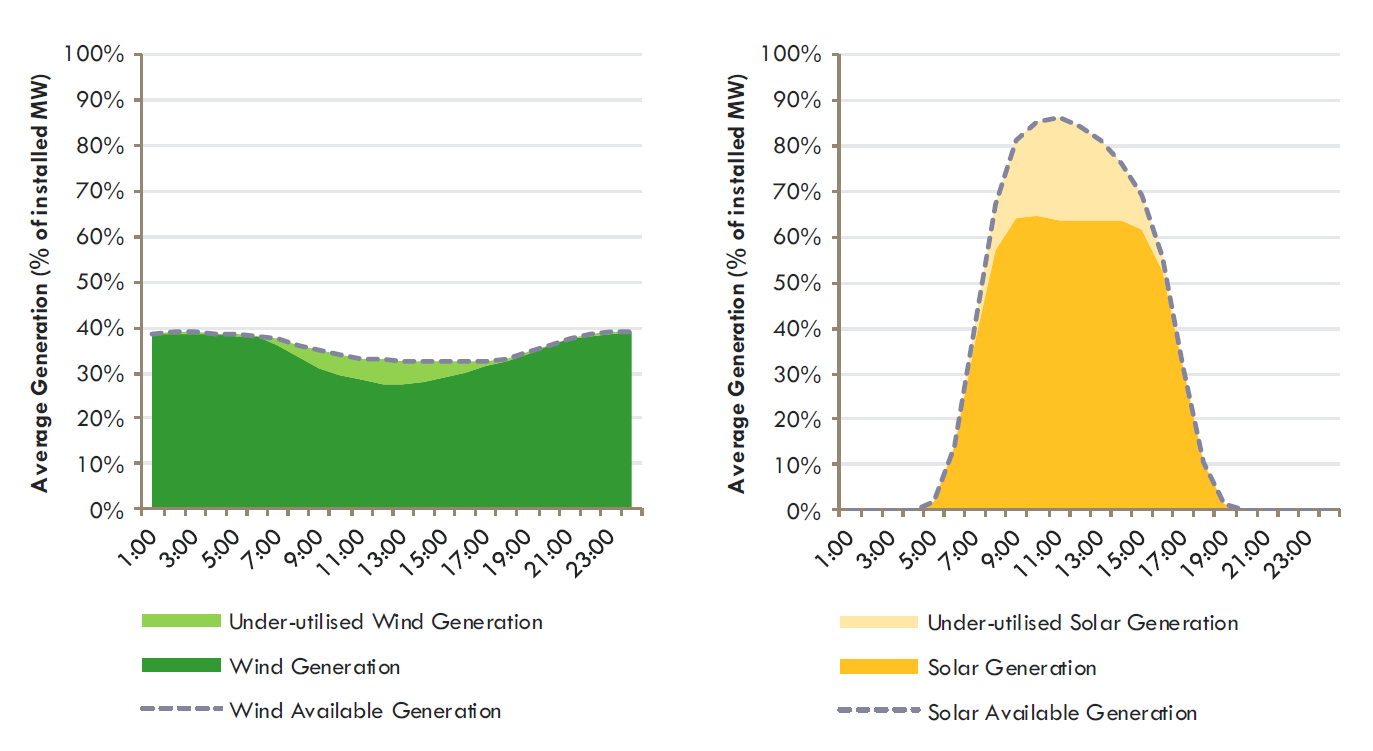

AEMO correctly identifies that the forecast levels of renewable energy generation will reach a point at which their output will be excess to the system’s requirements. Such over-supply of generation may be best utilised in replenishing utility-scale storage, or being used for industries which can handle excess, cheap power, such as renewable hydrogen (a subject for a later EnergyInsider piece).

Figure 3: Average utilisation of utility-scale renewable generation (Neutral case)

Source: AEMO, ISP, Figure 8, p.36

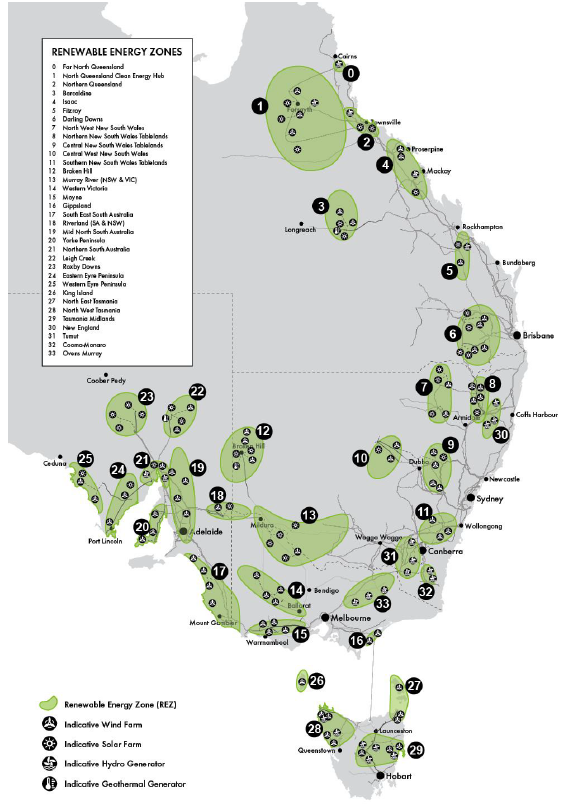

Renewable Energy Zones (REZs)

The Finkel Review mooted the idea of “renewable energy zones”, which could be supported by governments if the market was unable to deliver the necessary investment.[iii] AEMO identified 34 possible zones, as shown on the following figure. It concluded that:

- REZs should first be progressed where existing transmission capacity exists;

- following this, REZ expansion should be coordinated with identified transmission development to reduce overall costs; and,

- finally additional REZ augmentation should be coordinated to the extent possible to minimise costs.

Figure 4: Renewable Energy Zone candidates

Source: AEMO, ISP, Appendix A, Figure 3, p.7

The Development Plan

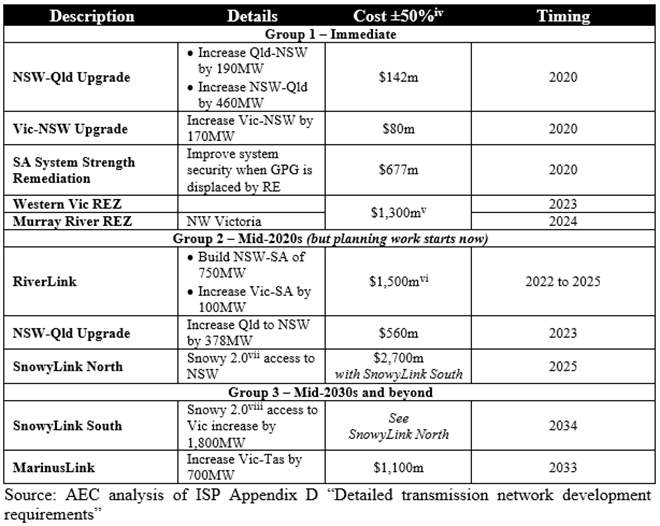

After taking the assumptions and conducting generation and economic modelling, AEMO has produced a 20-year development plan which is separated into three “groups”, as follows:

- Group 1: Immediate investment, with completion as soon as practicable;

- Group 2: Projects for implementation by the mid-2020s – although planning work needs to commence immediately to meet the timetable; and,

- Group 3: Projects for the mid-2030s and beyond.

In total the projects add up to about $8 billion, with a 50 per cent margin of error. In addition there are a number of possible conditional network augmentations for implementation in the period 2031 to 2040 which are dependent upon renewable energy development.

The Benefits

AEMO conducted an economic assessment to determine the market benefits from the Base Development Plan (which includes everything except MarinusLink). There were four categories for benefits, being:

- capital deferral of generation investment due to increased transmission capacity;

- fuel savings, primarily due to generation with lower fuel costs displacing higher cost generation;

- the capital deferral benefit by reducing the transmission investment needed to connect REZs; and,

- operating and maintenance benefits.

The annual benefits were then netted against generation and transmission investments converted to annual cash flow equivalents, and the derived values discounted to determine a net present value.

AEMO deduced that the Base Development Plan (comprising $7 billion of transmission network investments) would return net benefits of $1.2 billion.[ix]

Conclusion

AEMO’s work is helpful in addressing the technical challenges of catering for a power system in transition, however while adding and upgrading transmission infrastructure is one means by which reliability and security can be maintained to meet the required standards, it is not the only answer, with market-based solutions a viable alternative.

Most of the cost estimates in the ISP have a 50 per cent uncertainty associated with them and along with the significant uncertainty of modelling the NEM out to 2040, readers should ascribe very low confidence to the reported benefits. Irrespective of whether the benefits are credible or not, it is misleading to report aggregated benefits. While there are interdependencies and commonalities, it is important that each individual project is assessed on its own merits, and neither receives a cross subsidy from other projects, nor provides one.

It is also important to consider the National Electricity Objective, which sets out the need for investments in and the operation of the NEM to be efficient and in the long-term interests of electricity consumers. The Energy Council would argue that the market should identify power system shortcomings and opportunities, and respond in the most efficient manner, whether that be via generation assets, network augmentation or interconnection. While the ISP can point to apparent opportunities for needs to be addressed, it should not be taken as a blessing for transmission solutions to be implemented untested, at the cost of efficient market development.

[i] Finkel et al., Independent Review into the Future Security of the National Electricity Market: Blueprint for the Future, 2017

[ii] http://www.aemo.com.au/Electricity/National-Electricity-Market-NEM/Planning-and-forecasting/National-Transmission-Network-Development-Plan

[iii] Finkel Review, Recommendation 5.2

[iv] ISP, Appendix D, Table 41, p.68ff.

[v] Unable to be separated from the detail in the ISP. May also include a contribution towards the Moyne and Riverland REZs

[vi] Modelled in the ISP as $1.27b

[vii] If approved

[viii] If approved

[ix] ISP, Table 11, p.94

Related Analysis

Data Centres and Energy Demand – What’s Needed?

The growth in data centres brings with it increased energy demands and as a result the use of power has become the number one issue for their operators globally. Australia is seen as a country that will continue to see growth in data centres and Morgan Stanley Research has taken a detailed look at both the anticipated growth in data centres in Australia and what it might mean for our grid. We take a closer look.

Green certification key to Government’s climate ambitions

The energy transition is creating surging corporate demand, both domestically and internationally, for renewable electricity. But with growing scrutiny towards greenwashing, it is critical all green electricity claims are verifiable and credible. The Federal Government has designed a policy to perform this function but in recent months the timing of its implementation has come under some doubt. We take a closer look.

Energy regulation: A tale of increasing overload?

The energy sector is seeing an increase in regulation, with the retail laws and rules seemingly being changed year on year. This has led to old, overlapping or obsolete regulation not being removed, making it difficult for retailers to comply with, and regulators to enforce these rules and laws. We take a look at how overregulation is affecting customers and the cost of electricity.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.