World Energy Outlook 2015

The International Energy Agency’s annual World Energy Outlook (WEO) publication forecasts electricity demand, investment, generation capacity and trends in energy consumption until 2040. Three policy scenarios are analysed throughout the WEO report. This article uses the New Policy Scenario, where government policies as of mid-2015 have been formally adopted and any relevant policy proposals have been included in the WEO assumptions.

Global Investment forecast

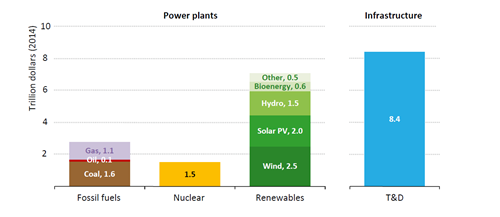

Over the outlook period 2015-2040 the cumulative global investment in the power sector is forecast to be US$19.7 trillion[i] (A$29 trillion[ii]) , or US$760 billion (A$1.1 trillion[iii]) annually. Investment in power plants accounts for 58 per cent of the total. Of this, 62 per cent of the total investment in power stations is allocated to renewables. Investment in renewable energy increases over the outlook period as existing power stations reach the end of their expected life spans (25 years) and need replacing. The remaining 42 per cent of cumulative global investment is allocated to transmission and distribution assets. Figure 1 shows the breakdown of investment over the period. Non OECD countries lead the way, spending almost two thirds of the US$19.7 trillion.

Figure 1: Global cumulative investment in the power sector by type in the New Policies Scenario, 2015-2040

Changing energy mix

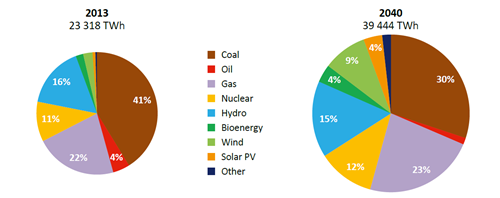

From 2013 to 2040, electricity demand is expected to increase by 70 per cent from 23,318 TWh to 39,444 TWh. Figure 2 shows the change in energy mix over the outlook period. Coal decreases its market share from 41 per cent to 30 per cent. However, the growth in total generation means that the amount of coal used in generation increases by 27 per cent from 2013 levels. All types of energy increase production, with the exception of oil.

As the world moves to a less carbon intensive energy mix, while seeking to ensure ongoing supply reliability, it is projected to support the use of gas, which is the only fossil fuel to increase its market share in the scenario. As demand for gas increases, the need for extraction of unconventional gas to meet demand also grows.

Figure 2: World electricity generation by type in the New Policies Scenario

Note: Other includes geothermal, concentrating solar power and marine.

Unconventional gas consists of tight gas, shale gas and coal seam gas (CSG). In 2012, a special report from the IEA, “Golden Rules for a Golden Age of Gas” which argued that unconventional gas needed to overcome important hurdles to continue to increase its market share of the world’s energy mix. The earlier report highlighted seven golden rules, which are reiterated in the World Energy Outlook 2015. These rules are:

- Measure, disclose and engage, involving meaningful and timely engagement with local communities, establishing key environmental baselines before drilling and disclosure of key operational data, including on hydraulic fracturing.

- Watch where you drill, taking into account established settlement patterns and local ecology, plus key geological and hydrological factors, such as the presence of faults or water supplies and sources.

- Isolate wells and prevent leaks, through ensuring well integrity and preventing and containing surface spills.

- Treat water responsibly, by reducing freshwater use, and paying close attention to treatment, storage and disposal of waste water.

- Minimise air emissions, by reduced flaring, eliminating venting and careful attention to other emissions.

- Consider the cumulative and regional effects of large-scale drilling and production operations, especially for water.

- Ensure consistently high, ongoing environmental performance, with properly resourced regulators, encouraging performance-based regulation and full cradle-to-grave regulation.

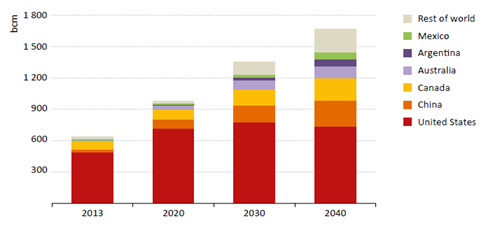

Figure 3 shows the expected increases in unconventional gas production around the world. As can be seen Australia’s increase in volumes of unconventional gas over the period 2013-2020 is due to CSG projects in Queensland becoming operational.

Figure 3: Unconventional gas production by key country in the New Policies Scenario

The World Energy Outlook takes a deeper look at three countries and the effects that different regulatory approaches are having on the exploration and extraction of unconventional gas. The three countries examined are the United States, Canada and Australia. These countries are similar in that all three have allocated primary responsibility for unconventional gas in state or provincial governments but have also retained responsibilities at a federal level for broader issues such as water catchment areas.

Each state in Australia regulates development of natural resources separately. Queensland is the most advanced from both a production and regulatory viewpoint. Queensland has regulations focused on water and carries out long-term research and monitoring activities. It also has regulations focused on CSG requiring inspection and monitoring of gas wells, drilling rigs and water wells. In 2013 the Queensland government also created the Gas Fields Commission to encourage co-operation between the CSG industry and communities. The IEA credits Queensland with following regulatory best practice, but also notes that Queensland’s low population, and history of successful mining developments were influential in that state’s successful production of unconventional gas.

Currently New South Wales and Victoria have separate moratoriums on unconventional gas developments. New South Wales have placed a moratorium on further activities in Sydney’s drinking water catchment areas and a prohibition on development in and within two kilometers of existing and future residential zones. In Victoria a full moratorium remains in place on hydraulic fracturing.

The need for unconventional gas in the future is clearly increasing. The increase of intermittent generation and emphasis on less emissive fuel sources are the key drivers behind the increase. Gas will play a role in the future reliability of electricity supply due to its fast starting nature and low CO2 output compared to other fossil fuels.

The federal government has taken positive steps in the area of unconventional gas. The creation of an independent scientific committee to provide advice on the impact of CSG and mining projects on water resources was recently created. It will be interesting to see how state governments react to independent expert advice. In 2013 the Gas Market Taskforce recommended a series of regulatory measures surrounding CSG in Victoria. These measures were subsequently rejected by the Victorian government who did not reconsider the moratorium.

[i] The current exchange rate is 1.45

[ii] http://www.xe.com/currencyconverter/convert/?From=USD&To=AUD

[iii] http://www.xe.com/currencyconverter/convert/?From=USD&To=AUD

Related Analysis

International Energy Summit: The State of the Global Energy Transition

Australian Energy Council CEO Louisa Kinnear and the Energy Networks Australia CEO and Chair, Dom van den Berg and John Cleland recently attended the International Electricity Summit. Held every 18 months, the Summit brings together leaders from across the globe to share updates on energy markets around the world and the opportunities and challenges being faced as the world collectively transitions to net zero. We take a look at what was discussed.

Great British Energy – The UK’s new state-owned energy company

Last week’s UK election saw the Labour Party return to government after 14 years in opposition. Their emphatic win – the largest majority in a quarter of a century - delivered a mandate to implement their party manifesto, including a promise to set up Great British Energy (GB Energy), a publicly-owned and independently-run energy company which aims to deliver cheaper energy bills and cleaner power. So what is GB Energy and how will it work? We take a closer look.

Delivering on the ISP – risks and opportunities for future iterations

AEMO’s Integrated System Plan (ISP) maps an optimal development path (ODP) for generation, storage and network investments to hit the country’s net zero by 2050 target. It is predicated on a range of Federal and state government policy settings and reforms and on a range of scenarios succeeding. As with all modelling exercises, the ISP is based on a range of inputs and assumptions, all of which can, and do, change. AEMO itself has highlighted several risks. We take a look.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.