The ins and outs of generation

The announcement by AGL Energy that it will defer the planned mothballing of four gas-fired turbines at the Torrens Island Power Station in South Australia (SA) has again highlighted the challenges involved in transforming our electricity supply.

AGL announced at the end of 2014 that the four units which made up the older Torrens Island A station with a capacity of 480MW would be taken out of service by 2017, based on the market outlook.

But the retirement of baseload plant in SA - with the decommissioning of Alinta Energy’s 544MW Northern and 240MW Playford B (which was previously mothballed) brown-coal fired generation at Port Augusta on 9 May – led to changes in market conditions “to the extent that there has been a significant tightening of supply to the market”[i] and prompted AGL’s decision to defer. AGL also pointed to the role that Torrens Island A would play in maintaining SA’s security of supply, which has come into stronger focus with the growth in SA of intermittent renewable generation.

In announcing the closure of its brown coal assets at Port Augusta, Alinta said key factors were a drop in demand as households became more energy efficient and the number of industrial customers fell, combined with the growth in renewable energy generation, which increased pressure on wholesale prices[ii]. Even though brown-coal is low cost, coal-fired generators have significant capital, operational and maintenance costs, which necessitate a high utilisation factor to remain economically viable.

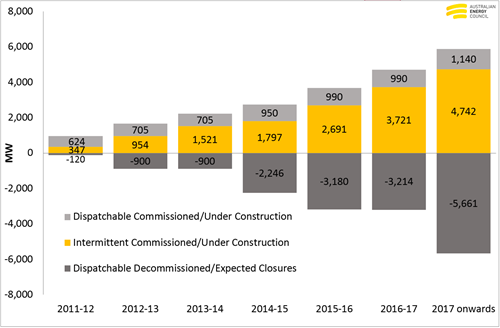

Figure 1 provides an overview of the changes underway in Australia’s generation. It shows generation entry and exit from 2011-12. For simplicity, the analysis only includes prospective projects that are under construction or approved with set construction dates.

Figure 1: Cumulative Generation Exit and Entry (MW) between 2011-12 and 2022-23 period

Source: Australian Energy Council analysis

In the 2015-2016 financial year, Alcoa of Australia Limited advised that Anglesea Power Station in Victoria would be withdrawn from service following the closure of the Alcoa Point Henry aluminium smelter, which underpinned energy production in the facility in the past. This closure and the removal of the SA power stations permanently removed a cumulative 934 MW of coal-fired capacity from the National Electricity Market. In addition to these closures, the Liddell Power Station (2,000 MW) coal-fired power station will be retired by 2022.

Dispatchable versus intermittent plant

The Renewable Energy Target, along with state-based renewable energy schemes, have supported an influx of intermittent generation. As shown in Figure 1, overall, 894 MW of new wind and solar has been publicly announced, completed or has been commissioned during 2015-16, while 1,030 MW of new projects are expected to be completed in 2016-17.

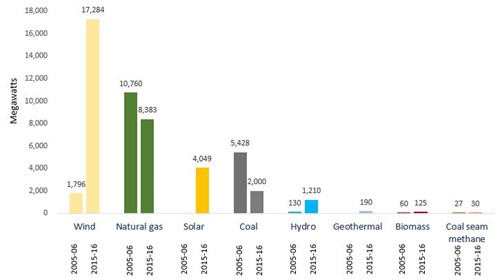

Figure 2 shows the shift that has occurred between 2005-06 and 2015-16 with proposed projects shifting from fossil fuels to renewable generation. In 2005-06 coal and gas generation dominated all prospective generation developments. The project status outlined in figure 2, shows that gas accounted for 59.1 per cent, while coal accounted for 29.8 per cent of projects by capacity in 2005-06. In comparison, wind accounted for less than 10 per cent, while solar did not feature in any investment proposals.

Figure 2: Proposed, Approved, Advanced Planning and Under Construction projects in 2005-06 and 2015-16

Source: Electricity Gas Australia, Australian Energy Council analysis

Note: In 2005-06, the chart includes proposed, advanced planning and under construction projects

In 2015-16, the chart includes proposed, approved, advanced planning and under construction projects

In contrast in 2015-16, wind, gas and coal account for 51.9 per cent, 25.2 per cent and 6 per cent respectively of all prospective generation developments. With a number of government schemes supporting less emissions intensive technologies, the total of wind capacity proposed, approved, in advanced planning or under construction has increased 10-fold in 2015-16. South Australia is the leading jurisdiction for installed and proposed wind farms across Australia.

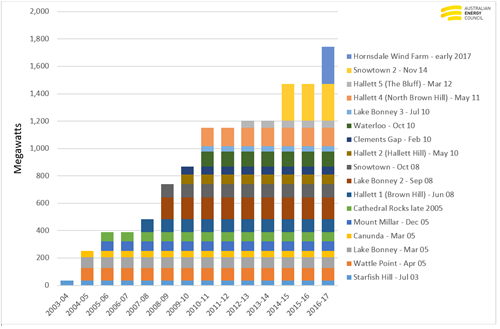

Figure 3 provides the total installed wind capacity in South Australia since 2003-04, as well as capacity under construction, along with its expected commissioning dates.

Figure 3: Installed wind capacity in South Australia (project name – commissioned date)

Source: Electricity Gas Australia, Australian Energy Council analysis

Note that nationally 6,230 MW of wind projects and 2,000 MW of black coal projects have been approved, but do not have construction dates. In South Australia 15 out of 18 prospective projects are wind powered and more than half of them have planning approval.

[i] AGL to defer mothballing of South Australian generating units, AGL media release, 6 June 2016

Related Analysis

2025 Election: A tale of two campaigns

The election has been called and the campaigning has started in earnest. With both major parties proposing a markedly different path to deliver the energy transition and to reach net zero, we take a look at what sits beneath the big headlines and analyse how the current Labor Government is tracking towards its targets, and how a potential future Coalition Government might deliver on their commitments.

A farewell to UK coal

While Australia is still grappling with the timetable for closure of its coal-fired power stations and how best to manage the energy transition, the UK firmly set its sights on October this year as the right time for all coal to exit its grid a few years ago. Now its last operating coal-fired plant – Ratcliffe-on-Soar – has already taken delivery of its last coal and will cease generating at the end of this month. We take a look at the closure and the UK’s move away from coal.

Delivering on the ISP – risks and opportunities for future iterations

AEMO’s Integrated System Plan (ISP) maps an optimal development path (ODP) for generation, storage and network investments to hit the country’s net zero by 2050 target. It is predicated on a range of Federal and state government policy settings and reforms and on a range of scenarios succeeding. As with all modelling exercises, the ISP is based on a range of inputs and assumptions, all of which can, and do, change. AEMO itself has highlighted several risks. We take a look.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.