Regulator shines a light on NSW wholesale market

This week the Australian Energy Regulator (AER) released its review into the “step change” in wholesale electricity prices in NSW since late 2016. This was the first review under the AER’s new wholesale market monitoring powers, so it was an important opportunity to shed a clearer light on what is driving up wholesale electricity prices.

The review was triggered by media reporting of a Schneider Electric briefing note in August this year, which claimed that in NSW “recent, aggressive generator bidding behaviour is unprecedented and opportunistic, as it does not appear to be underpinned by cost drivers alone.” In September the Energy Minister asked the AER to investigate.

The AER’s advice acknowledged the “step change” in NSW wholesale electricity price. It found that the increase had been driven by several factors including coal issues (supply and transport problems), higher gas prices, and fewer electricity imports of cheaper brown-coal generated electricity from Victoria following the closure of Hazelwood power station. It did not find “evidence to suggest that prices were being driven by behaviour we would traditionally associate with the exercise of market power in electricity markets, such as rebidding significant capacity at prices near the price cap close to dispatch”.

The review highlighted the following issues:

- Higher coal prices. The review confirmed that NSW generators’ coal costs are increasing, particularly under short-term contracts. It also highlighted that strong Chinese demand had contributed to rising international coal prices and generators are exposed to rising prices where contracts are benchmarked against international prices.

- Problems with coal supply. Stockpiles were “significantly” lower than historic levels. Generators sought to supplement their reduced stockpiles using higher priced short-term contracts, but stockpiles did not recover.

- Transport issues. Generators depending on the rail system had lower than forecast coal deliveries because of a range of rail network and haulage problems[i].

- Coal supplier issues. Future coal supply concerns, most notably for the Mt Piper power station with uncertainty around the future of the Springvale coal mine (the only mine supplying the plant) due to planning and environmental litigation, which was only resolved by the NSW Government passing new laws in October.

- Higher gas costs. As previously noted, gas prices across the east coast have risen steeply over the past few years. The AER’s analysis of confidential information from gas-fired generators confirmed gas costs increased from mid-2016.

- Closure of coal plant. The loss of Victoria’s Hazelwood power station lessened the opportunity for imports of cheaper brown-coal generation. The AER notes that while imports from Queensland have increased, “it is not clear these imports provide the same competitive constraint” on offers of NSW generators as cheaper imports from Victoria.

The AER also noted that another factor was the reduced availability of hydro generation in the lead up to summer, as Snowy Hydro conserved its finite fuel resource.

Generation Mix

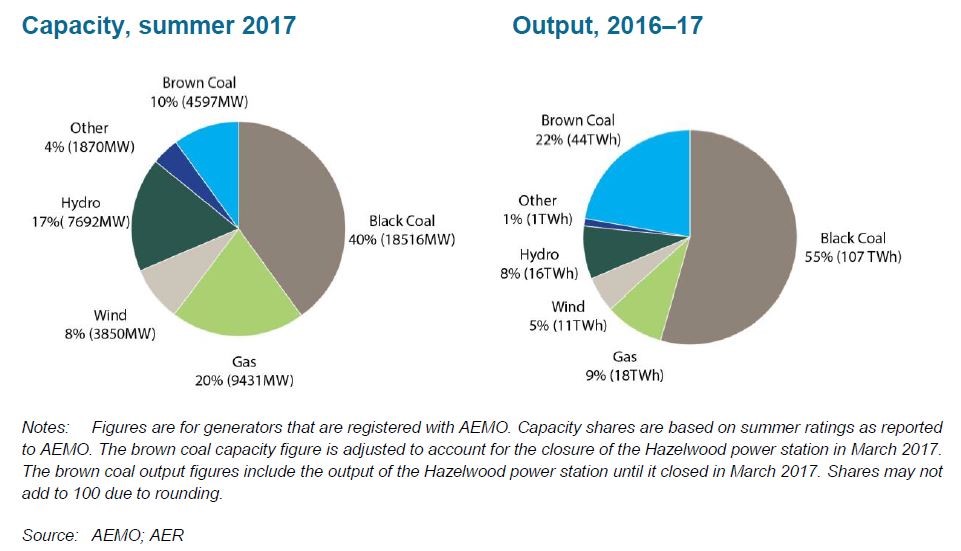

The briefing note provides useful insight into how generators bid and operate in wholesale electricity markets. In NSW coal is the dominant generation fuel. There are five black coal-fired plants with a total capacity of approximately 10,260MW. They accounted for 88 per cent of total output in 2016-17. Hydro and gas accounted for 9 per cent of total output in that period.

Figure 1: Generator capacity and output in NSW, by fuel source

The AER observed that a market dominated by a small number of large generators is “likely to be less competitive than a market with more generators” and notes that NSW is dominated by a few large, vertically integrated participants.

With five major generators and renewables at around 4 per cent of capacity and output, as well as nine wind and solar generators outside the five major generators, NSW is the most competitive electricity market in Australia. The Schneider Electric concerns around the lack of relationship between cost of production and how prices are reached misses the point of the National Electricity Market design. Because electricity is a commodity that can’t be stored, the market discovers prices which reflect the demand-supply balance, not the cost of production. For operational reasons, generators regularly bid well below operating cost, even in a higher priced market. The AER review revealed that around 30 per cent of capacity in NSW is still offered at less than $0[ii].

No Evidence of Opportunistic Bidding

In considering market power the AER notes that there are certain types of opportunistic bidding commonly linked to use of that power which include physically withholding capacity and shifting capacity to extreme prices. But it notes that in the past year it has not identified instances where this has significantly impacted NSW average price outcomes. The AER said:

- Generators did not appear to physically withhold capacity from the market. The capacity offers to the market has remained fairly constant except for some outages;

- Whilst NSW generators offered increased capacity at higher prices in 2017, “we did not observe instances of participants shifting capacity to extremely high prices”;

- NSW generators did not significantly rebid capacity from low to high prices close to dispatch;

- It did not detect “false or misleading rebidding”; and,

- Did not identify any instances in 2017 where Snowy Hydro’s bidding constrained the Victoria-NSW interconnector affecting price outcomes in NSW.

It also commented that assessing each participants offer behaviour “suggests that the changes were based on individual participants’ circumstances and did not involve co-ordinated behaviour”.

The review also notes that some of the issues that have contributed to high generator offers in NSW appear to be improving, notably concerns over coal supplies.

The report goes on to say that there is the need for more work to understand the impact of changes in the market. “[T]here are a number of factors that need to be considered over a longer period to make an informed assessment of the effectiveness of competition in the NSW market” and “reach any definitive conclusions.”

Conclusion

The AER’s report is unremarkable in many regards because many of the factors impacting generators in NSW were widely known and reported on, such as the increasing pressure on coal prices and supply, the increased price of gas in the east coast market and the closure of Hazelwood, which had been a source of cheaper brown-coal generation to NSW.

Using its wholesale monitoring powers, the AER has investigated the supposed “opportunistic generator bidding behaviour” and concluded that there is no evidence to suggest this. This should provide stakeholders with confidence that the NSW wholesale electricity market is functional and competitive.

[i] These included rail network congestion, infrastructure failure and industrial action.

[ii] AER NSW electricity market advice, page 16

Related Analysis

Is increased volatility the new norm?

This year has showcased an increased level of volatility in the National Electricity Market (NEM). To date we have seen significant fluctuations in spot prices with prices hitting both maximum price caps on several occasions and ongoing growth in periods of negative prices with generation being curtailed at times. We took a closer look at why this is happening and the impact this could have on the grid in the future.

Is there a better way to manage AEMO’s costs?

The market operator performs a vital role in managing the electricity and gas systems and markets across Australia. In WA, AEMO recovers the costs of performing its functions via fees paid by market participants, based on expenditure approved by the State’s Economic Regulation Authority. In the last few years, AEMO’s costs have sky-rocketed in WA driven in part by the amount of market reform and the challenges of budgeting projects that are not adequately defined. Here we take a look at how AEMO’s costs have escalated, proposed changes to the allowable revenue framework, and what can be done to keep a lid on costs.

Offshore wind feasibility licenses have been granted – what are the proposals and who’s behind them?

The Federal Government has announced the first proposed offshore wind projects to receive a feasibility licence for development of generation in the Gippsland Offshore Wind Zone. We take a look at the proponents and projects.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.