Being Alan Finkel: A daunting task

Professor Alan Finkel and his team are currently bunkered down writing their final report for their Independent Review into the Future Security of the National Electricity Market. Due mid-year, the report is loaded with great expectations.

It is not an easy brief. Solving Australia’s energy policy disarray is challenging, not only because the starting place is a degraded and increasingly fragile electricity system resulting from a decade of policy uncertainty and investment paralysis.

Any successful reform agenda will also need to manage the multiple and simultaneous exogenous shocks occurring to developed economy electricity systems: decarbonisation, increased consumer participation, decentralisation of generation and uncertain demand trends in addition to allowing for potentially increased disruption from new technologies across the supply chain.

A successful revised electricity system will:

- enable decarbonisation that at least meets international emissions milestones at the lowest cost

- sustain existing (high) reliability and system security

- successfully signal and reward efficient investments and encourage innovation

- be technology neutral, and

- enable efficient new entrants and new technologies without rewarding rent seeking or advantaging incumbency.

So what might a final Finkel review report look like? What are the key issues it is likely to consider? What do we need to do to reform the National Electricity Market (NEM) to make it fit for purpose in the 21st century?

Multiple reforms needed

If we logically assume that the NEM will remain the centre piece of the electricity system, and the existing institutional arrangements (a market operator -AEMO -, a regulator -AER - and a rule maker -AEMC -), then what framework is needed around this?

A decade ago the general policy wisdom was that the preferable reform path was a single, decisive constraint on greenhouse emissions. This would internalise the cost of pollution and the market would then discover the most efficient way of managing this constraint. Instead of this, most change in the NEM and the South West Interconnected System (SWIS) has been achieved by renewables policy that has installed mostly intermittent generation without consideration of system security. This has, in turn, resulted in the challenges now being experienced in South Australia.

While it is likely that many of the technical and operational challenges faced by the electricity market are a product of partial or poorly designed policy, it is impractical to think that these consequent conditions can simply be unwound. Future reforms will need to work with the assets already in place.

It is increasingly apparent that a single, national policy to constrain/price emissions is necessary, but probably not sufficient. It may be useful to catalogue the suite of possible reforms under two broad categories: national policy reforms and technical/operational reforms.

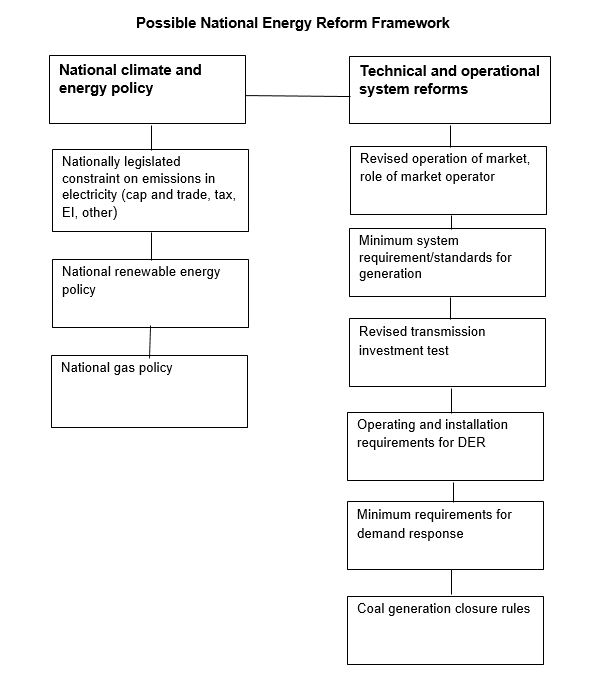

Possible National Energy Reform Framework

We’ve notionally come up with three policy reforms and six areas of operational reform that would fall under consideration for comprehensive reform of the NEM. This is not an exclusive list. A number of these areas are already the subject of their own specific debate or reform processes. It may be useful to organise them together as most of these are co-dependent. For instance the increased scarcity of domestic gas increases the carbon price or its equivalent needed to enable investment in new gas generation (and operate existing gas generation).

Policy

National emissions constraint/price

The centrepiece of public debate on climate and energy policy for the past decade has been whether and how to constrain emissions. This can be done through a trading scheme for emissions, a carbon tax, an emissions intensity scheme, via regulation, baselines, or indirectly by subsidies for low emissions technologies. The cost of these various options have been recently comparatively modelled by Jacobs for the Climate Change Authority[i] and Frontier Economics for the Australian Energy Market Commission[ii].

This remains the most politically contentious element of any reform of the NEM, and yet it is also central to its successful reform. The key test of success for any eventual policy design proposed is the extent to which it resuscitates investment in new generation to replace retiring generators. Both the Jacobs and Frontier modelling suggest market-based mechanisms are more efficient.

National renewable energy policy

The current Renewable Energy Target concludes in 2020 with the tail of certificates for existing projects ending in 2030. It was originally designed to work alongside a carbon price which it was intended would obviate the need for renewables policy from that point onwards. The RET’s design objective is to bridge the cost gap between the wholesale spot price and lowest cost renewables price, but does not consider system security, or the value of other supporting services.

Renewables will play an increasing role in electricity this century, and will be expected to increase their capacity in the NEM behind well designed climate and energy policy. To date there has been insufficient planning and consideration made for the impact of high levels of intermittency, which clearly must be addressed to enable further decarbonisation of the grid. The question is whether there is a role for specific renewables policy, or whether this is achieved through other integrated measures.

National gas policy

Gas and access to gas is a crucial issue for energy policy in Australia. Australia has abundant gas reserves and is on target to become the world’s biggest gas exporter by 2020, but has a worsening domestic supply shortage. Gas is likely to be an increasingly important input into electricity supply as we develop alternative, lower emissions dispatchable generation to coal. The cost of gas will materially influence the effectiveness of national electricity and emissions policy and its cost.

Proposed solutions include the removal of existing state moratoria, development of domestic tenements, improved community engagement and support and some suggest even more radical steps like domestic reservations policy on the east coast. What is clear is that successful electricity market reform will depend on more liquid domestic east coast gas markets.

Operational

Revised operation of the market and the role of the operator

The role of the Australian Energy Market Operator (AEMO) in the original 20th century design of the NEM has become significantly more challenging with increased intermittent supply and distributed generation. AEMO’s role has always been to balance demand with supply. This has become increasingly more challenging when available capacity is increasingly dependent on factors AEMO cannot control (wind, sun) or see (unscheduled generators). Wind forecasting is increasingly important but not infallible. Intermittent generators can be turned off or down, but cannot be increased at critical times. At scale this reduces AEMO’s ability to respond quickly to unexpected events.

Some of the recent blackouts in South Australia could have been avoided if the market had been operated differently. It is likely new, unforeseen situations could still occur. Clearly the market operator needs a new rule book to operate a new grid, but applying this in practice is not so simple. For example, if AEMO did direct the SA grid on 28 September to decrease supply from the interconnector and increase local firm generation, it would have also increased the wholesale price. Repeated interventions like this would reduce reliability risks, but at a higher cost. How does an AEMO 2.0 operate a NEM 2.0 to solve two competing objectives simultaneously, ie minimise price increases but sufficiently manage reliability?

Generation requirements

The development of electricity grids over the 20th century based on mostly firm generators masked the value of many of its subtler properties. Only as firm generation becomes more scarce do we realise the value of frequency and voltage management, inertia and fast response. Supply of new lower emissions generation to date has focussed on its energy value only.

Future generation will need to increase or at least sustain power quality. Currently it is likely this package of services and functions will come from a range of technologies. An important decision is whether each market participant is required to package up a complete solution or whether AEMO procure sufficient quantities of each service for the system as a whole. Again this is simple at a theoretical level, but will require careful consideration at the operational level to enable innovation and efficient solutions. These conditions may also vary in different parts of the NEM.

Transmission

Connecting the eastern states via transmission lines was a key part of creating the NEM. Transmission will continue to provide the ability to move electrons large distances, which may be valuable as the grid evolves and becomes more dynamic. Transmission can also lower costs, but as we have seen in South Australia, this can also unwittingly reduce system security and undermine the viability of some generators. Transmission by its nature is designed to operate constantly rather than as an emergency solution.

The factors that inform efficient transmission investment in the future are becoming more complex as the grid becomes more complex. The pure market case for new transmission is as challenging as the ability to build new generation. The test for regulated transmission assets may need to evolve to reflect these changing dynamics.

Distributed generation

With more than 1.6 million Australian rooftops supporting solar PV generators, it is clear that distributed generation will play an increasing role in the 21st century grid. Storage and other “consumer” level technologies may follow. These generators in aggregate already are equivalent to multiple utility scale generators in each state, yet they are still relatively invisible to the market operator and are not currently controllable.

How does the 21st century NEM better monitor and manage current and future distributed energy resources so that the consumers who invested in the technology are informed and appropriately rewarded, and the operation of the grid is improved. How does AEMO plan for a future grid where it is unknown whether existing distributed generation assets will be maintained, replaced, upgraded or abandoned?

Energy efficiency, flexibility and demand response

For decades until 2009 economic growth and electricity demand were highly correlated. Demand planning was based on economic forecasts. Then for the next six years this correlation ended. The economy continued to grow while electricity demand fell sharply. This had many causes including the price effect from rising electricity prices behind higher network costs, the effect of large energy efficiency schemes like the controversial home insulation scheme), a structural shift in the economy with the closure and decline of some energy intense trade exposed sectors and growth in lower energy services, and the sustained effect of newer and more efficient appliances penetrating the market.

The point being that active and passive energy efficiency has improved national energy productivity, but it has also made demand forecasting more challenging, which has in turn increased the risk of new generation. Better understanding of the drivers of changes in electricity demand will enable better planning and greater confidence in demand forecasts.

Increased generation by zero marginal cost intermittent generators like wind and solar also change the value of energy efficiency. Given there will be times when there is abundant energy and times when it is scarce, there will be an increased value placed on energy flexibility. A NEM that can monetise this value will enable technologies like storage and improve the value case for technologies that provide firm demand response in households and businesses.

Coal-fired generation closure

The recent closure of two major coal-fired generators in South Australia and Victoria has raised the issue of how such closures can be better managed to ensure appropriate lead times for new replacement investment and ensure there is sufficient system security and capacity. Coal generators can close either because they reach the end of the operational life, or because they have been forced out of the market by greenhouse reduction measures. Either way, the owners of the asset do not want to operate plant that is no longer economic (or safe) to run.

One possible measure is to require a minimum notice period that a generator has to give when it intends to close. In some cases it is possible that a generator may be asked to close earlier than announced (as an additional emission reduction measure) or later (to maintain capacity or other services until a replacement is ready). They key here is how these closure conditions are packaged so that the asset owners are not financially disadvantaged and that there is sufficient flexibility in the operation of the asset as it approaches closure to ensure it can safely comply with requests to extend or close early.

Conclusion

Reforming the NEM to adequately manage the challenges of the 21st century is not simple. It will require a combination of policy and operational reforms, holding aside the political challenges of their implementation. Professor Finkel has been given a daunting task. Like many others, we await the release of his final report with great interest.

[i] Jacobs Group: “Modelling illustrative energy sector emissions reduction policies”, for the Climate change Authority, February 2017 http://climatechangeauthority.gov.au/sites/prod.climatechangeauthority.gov.au/files/files/170217%20Jacobs%20Final%20Report%28revised%29.pdf

[ii] Frontier Economics, “Emissions Reductions Options”, for the AEMC, November 2016 http://www.aemc.gov.au/Markets-Reviews-Advice/Integration-of-energy-and-emissions-reduction-poli/Final/AEMC-documents/Frontier-Economics-Report.aspx

Related Analysis

Climate and energy: What do the next three years hold?

With Labor being returned to Government for a second term, this time with an increased majority, the next three years will represent a litmus test for how Australia is tracking to meet its signature 2030 targets of 43 per cent emissions reduction and 82 per cent renewable generation, and not to mention, the looming 2035 target. With significant obstacles laying ahead, the Government will need to hit the ground running. We take a look at some of the key projections and checkpoints throughout the next term.

Certificate schemes – good for governments, but what about customers?

Retailer certificate schemes have been growing in popularity in recent years as a policy mechanism to help deliver the energy transition. The report puts forward some recommendations on how to improve the efficiency of these schemes. It also includes a deeper dive into the Victorian Energy Upgrades program and South Australian Retailer Energy Productivity Scheme.

2025 Election: A tale of two campaigns

The election has been called and the campaigning has started in earnest. With both major parties proposing a markedly different path to deliver the energy transition and to reach net zero, we take a look at what sits beneath the big headlines and analyse how the current Labor Government is tracking towards its targets, and how a potential future Coalition Government might deliver on their commitments.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.